Daisy Chain Crypto Archives: November 2025 Crypto Guides and Airdrops

When you’re trying to make sense of Daisy Chain Crypto, a practical guide platform for blockchain newcomers and experienced traders alike, focused on clarity and real-world action. It’s not just another crypto blog—it’s the place where people go when they’re tired of hype and want to know what actually works. In November 2025, the focus stayed tight: helping readers cut through noise with clear, tested advice on cryptocurrency guides, step-by-step resources that break down complex topics like staking, tokenomics, and gas fee optimization, and airdrops 2025, verified token distributions with real claim steps and scam warnings.

Daisy Chain Crypto doesn’t guess. It checks. Every airdrop listed was confirmed active, every exchange review came from real user experiences—no affiliate fluff. If a guide said "how to set up a wallet," it included the exact steps for MetaMask, Trust Wallet, and Ledger, with screenshots and common mistakes to avoid. The month’s top topics? crypto exchanges, platforms that actually delivered low fees and fast withdrawals in late 2025, and wallet security, how to protect your keys without overcomplicating your life. You won’t find vague advice like "just use a hardware wallet." You’ll find: which hardware wallets had firmware updates that broke staking, which apps still had phishing vulnerabilities, and how to spot a fake support chat in under 30 seconds.

November 2025 was the month when a lot of new users got burned by rushed token launches. Daisy Chain Crypto stepped in with DYOR checklists that actually worked—no buzzwords, just questions you need to ask before sending any crypto. Was the team doxxed? Was the contract audited by a firm you’ve heard of? Was the liquidity locked for more than 30 days? These weren’t theoretical questions. They were answers that saved people thousands.

What you’ll find below is everything published that month: the guides that got shared the most, the airdrops that paid out, the exchange updates that mattered, and the security alerts that kept readers safe. No filler. No recycled content. Just what you needed to know, when you needed to know it.

What is Omni Network (OMNI) Crypto Coin? Understanding the Two Projects Behind the Same Ticker

Omni Network (OMNI) refers to two separate crypto projects: an old Bitcoin-based token protocol and a new Ethereum rollup interoperability network. Learn the key differences, why confusion costs investors money, and which one actually matters today.

TradeSatoshi Crypto Exchange Review: Why This Platform Shut Down and What You Can Learn

TradeSatoshi was a crypto exchange that shut down in 2019, leaving users with lost funds. This review explains why it failed, the red flags to watch for, and what to use instead.

What is SavePlanetEarth (SPE) crypto coin? Real impact or just another greenwashing crypto?

SavePlanetEarth (SPE) is an Ethereum-based crypto claiming to fight climate change by funding tree planting and carbon capture. But with low liquidity, no verified impact, and questionable partnerships, it's more speculation than solution.

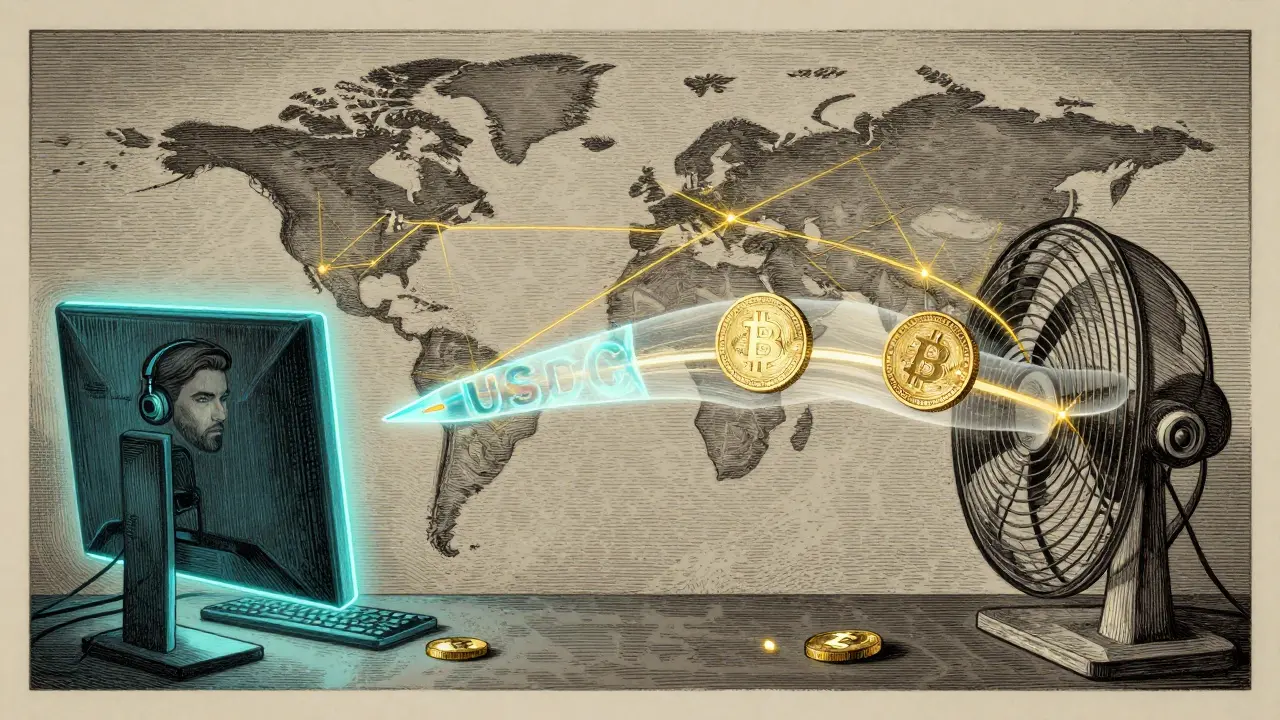

Direct Creator-to-Fan Payments with Crypto: How Creators Are Bypassing Platforms in 2025

In 2025, creators are bypassing platform fees and slow payouts by accepting direct crypto payments from fans. Learn how it works, which tools to use, and why it's changing the creator economy.

Elemon (ELMON) x CoinMarketCap Airdrop: What Happened and Where It Stands Today

The Elemon x CoinMarketCap airdrop in 2021 gave away ELMON tokens for free, but the token has since crashed over 99.9% with zero trading volume. Here's what happened and why it's not worth holding today.

Forward Protocol FORWARD Airdrop: How to Get Free Tokens and What’s Really Happening

Forward Protocol's FORWARD airdrop gave away over half its tokens to the community. Learn how it works, who got tokens, what’s still locked, and how to earn future distributions - without buying anything.