When you want to trade crypto, where you live can make all the difference. In the U.S., you might hop on Binance or Coinbase without a second thought. But if you’re in Nigeria, India, or Russia, those same platforms could be blocked entirely. Meanwhile, someone in Argentina or Ukraine might be using a decentralized exchange (DEX) to bypass those exact restrictions. This isn’t just about tech-it’s about money, freedom, and who gets to decide what you can do with your crypto.

Why CEXs Are Locked Down by Geography

Centralized exchanges (CEXs) like Binance, Kraken, and Coinbase act like banks. They hold your crypto, manage your account, and report to governments. Because of that, they have to follow local laws. If a country bans crypto derivatives, the exchange turns off that feature there. If a government demands user data, the exchange hands it over-or gets shut down. This creates a patchwork of access. For example:- In the U.S., Coinbase is fully licensed and offers fiat on-ramps via bank transfers.

- In the U.K., Binance is restricted from offering derivatives and must operate under strict reporting rules.

- In Nigeria, Binance was blocked by the central bank in 2021, and even now, users can’t deposit naira directly.

- In China, all CEXs are banned outright-no trading, no accounts, no exceptions.

How DEXs Bypass Geographic Limits

Decentralized exchanges (DEXs) like Uniswap, PancakeSwap, and dYdX don’t have headquarters. They run on blockchain code. No CEO. No customer support line. No license to renew. That’s why they’re harder to shut down. To use a DEX, you don’t sign up. You connect your wallet-MetaMask, Phantom, or Trust Wallet-and start trading. No ID. No address. No bank account. If you have crypto in your wallet, you can trade on a DEX from almost anywhere. This matters in places with strict capital controls:- In Venezuela, where the peso is collapsing, people use DEXs to swap stablecoins like USDT for Bitcoin to preserve value.

- In Iran, where U.S. sanctions block traditional banking, traders use DEXs to convert crypto into goods and services via peer-to-peer networks.

- In Thailand, where the central bank restricts CEXs, DEXs remain accessible because they don’t touch fiat.

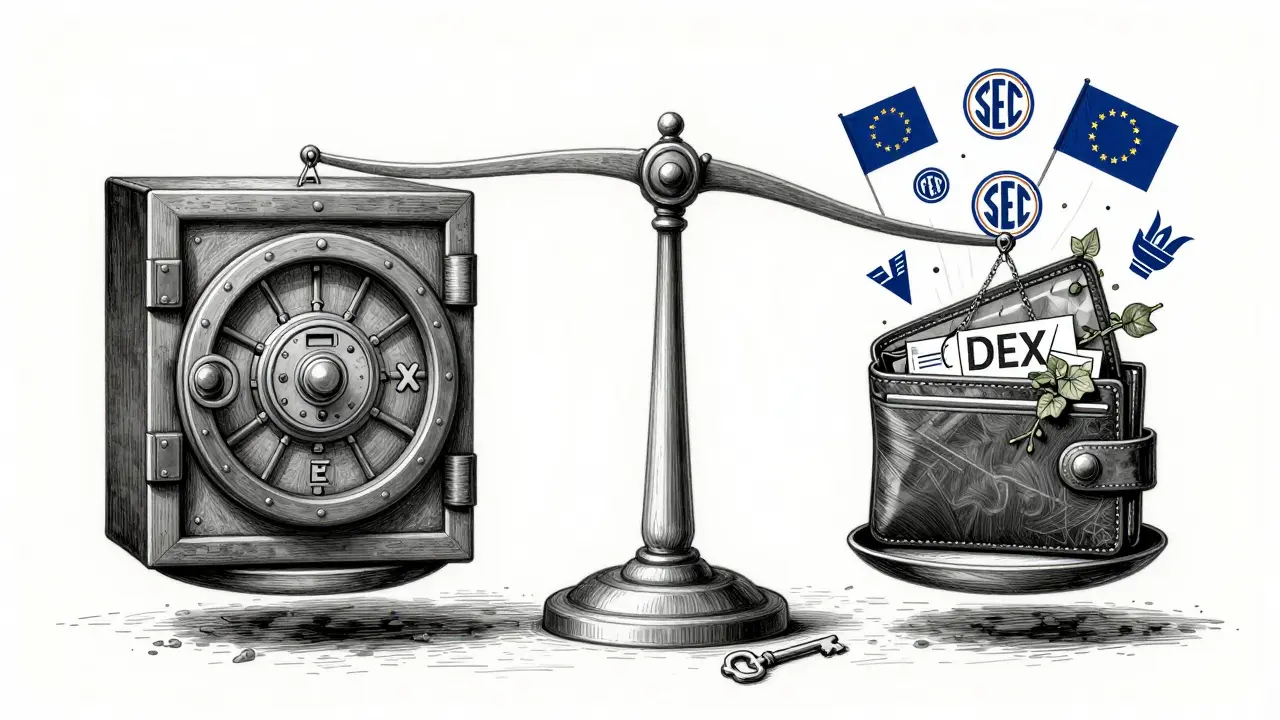

The Regulatory Shift: Even DEXs Aren’t Free Anymore

For years, DEXs operated in a gray zone. Regulators couldn’t target them because there was no company to sue. But that’s changing. In 2024, the EU’s MiCA regulation required DEXs to implement geographic restrictions if they offered services to EU residents. The U.S. SEC started targeting DEX developers who actively marketed their platforms to U.S. users. And in 2025, the FATF (Financial Action Task Force) pushed for global standards requiring DEXs to monitor transaction flows from high-risk jurisdictions. Now, some DEXs are adding geo-blocking features-not because they want to, but because they have to. Uniswap’s newer interface now detects IP addresses and blocks access from sanctioned countries. PancakeSwap quietly added a popup warning users in the U.S. that trading may violate local law. This isn’t the end of DEXs. But it’s the end of the idea that they’re completely free from regulation. The line between CEX and DEX is blurring. The tech is still decentralized. The rules? Not so much.Fiat Access: The Hidden Barrier

Here’s something most people miss: CEXs win when it comes to buying crypto with cash. They let you deposit dollars, euros, or yen directly. DEXs? You need crypto first. That creates a real-world gap. In countries with weak banking systems-like Nigeria or Argentina-getting crypto isn’t easy. You can’t just wire money to a DEX. You need to find someone who’ll trade Bitcoin for your local currency. That’s risky. It’s slow. And it’s often illegal. So while DEXs offer global access, they assume you already have crypto. CEXs make it easier to enter the system. But they also make it easier to lock you out.

Security and Control: Who’s Really in Charge?

On a CEX, your crypto sits in their wallet. If they freeze your account, you can’t move your funds. If they get hacked-like Mt. Gox or FTX-you lose everything. And if your country bans crypto, they’ll shut you down without warning. On a DEX, your crypto stays in your wallet. No one can freeze it. No one can seize it. But if you lose your private key? Too bad. No customer service. No reset button. This trade-off isn’t just technical-it’s philosophical. CEXs give you safety and convenience, but they also give governments control. DEXs give you freedom, but they put all the responsibility on you.What This Means for You

If you’re in a country with strict crypto rules:- CEXs might be your only option for easy fiat on-ramps-but they could vanish overnight.

- DEXs might be your only way to trade-but you’ll need to already own crypto and know how to protect it.

- Some users split their strategy: use a CEX to buy crypto with local bank transfers, then move it to a DEX to trade freely.

As regulations tighten, the smartest traders aren’t choosing one over the other. They’re using both-strategically.

Can I use a DEX if my country bans crypto?

Yes, technically. DEXs don’t require registration or KYC, so you can access them from almost anywhere as long as you have a crypto wallet. But if your government bans crypto ownership outright, using a DEX could still be illegal-even if the platform itself can’t stop you. Enforcement is up to local authorities, not the exchange.

Why do CEXs block users by IP address?

CEXs use IP blocking because they’re legally required to comply with national regulations. If a country prohibits crypto trading or requires specific licenses, the exchange must prevent access from that region. IP blocking is the fastest way to enforce this without shutting down the entire platform.

Are DEXs really unregulated?

Not anymore. While DEXs started as truly decentralized tools with no legal entity behind them, regulators now target developers, liquidity providers, and even front-end interfaces. In 2025, the EU and U.S. began requiring DEXs to implement geo-restrictions, meaning they’re no longer operating in a legal vacuum.

Can I use a VPN to bypass CEX restrictions?

You can, but it’s risky. Most CEXs detect and ban VPN usage. If caught, your account may be frozen, and you could lose access to funds. Worse, if you’re in a country where crypto is illegal, using a VPN to access a CEX could put you in legal jeopardy. It’s a workaround, not a solution.

Which is safer: CEX or DEX?

It depends. CEXs offer insurance, recovery options, and customer support-but they’re targets for hacks and government seizures. DEXs give you full control over your funds, but if you lose your private key or fall for a scam, there’s no one to help. Neither is inherently safer-it’s about how you manage risk.