When you hear about a crypto exchange that lets you trade meme coins with just a few taps inside Telegram - no KYC, no complex setup - it sounds like a dream. But when you dig deeper into Ebi.xyz, the dream starts to crack. This isn’t another Binance or Coinbase. It’s a niche, high-risk DEX built for traders chasing volatile meme tokens, and it’s flying under the radar of most mainstream crypto users. Whether you’re drawn in by the promise of quick profits or the hype around Hamster Kombat airdrops, you need to know what you’re really signing up for.

What Is Ebi.xyz, Really?

Ebi.xyz is a decentralized exchange (DEX) that lets you trade perpetual futures - essentially bets on whether a token’s price will go up or down - without ever handing over your crypto. That’s the core promise of any non-custodial platform: you hold your keys, you control your funds. But unlike Uniswap or dYdX, Ebi.xyz doesn’t use an automated market maker (AMM). Instead, it runs on a limit order book, the same system used by centralized exchanges like Binance. That’s a big deal for people who’ve traded on CEXs before. It feels familiar. You set your price, you wait for someone to match it. No slippage, no impermanent loss.

It runs on what it calls the "Ebi chain," an Ethereum Layer 2 built with Arbitrum Orbit. That means it’s faster and cheaper than trading directly on Ethereum, but still backed by Ethereum’s security. It launched in late 2021, so it’s been around for about three years. That’s not nothing, but in crypto time, it’s practically a baby. Most top DEXs have five to ten years of history. Ebi.xyz doesn’t.

The FUD Market: Betting Against Meme Coins

Ebi.xyz’s most talked-about feature is the "FUD Market." It’s the first perpetual DEX to offer short-only trading on meme coins. If you’ve ever bought a Pump.fun token and watched it crash 90% in a day, you know how brutal this space is. Over 1.9 million meme tokens have been created since Pump.fun launched. Almost all of them died. The FUD Market lets you bet against them - without owning them. You don’t need to buy the coin. You just short it. If it crashes, you profit.

This isn’t theoretical. In September 2024, Ebi.xyz reported over 145,000 new accounts in under a week. That spike didn’t come from nowhere. It came from the meme coin frenzy. Traders who lost money holding tokens suddenly saw a way to profit from their failure. And for those who understand how to short, it’s a powerful tool. But here’s the catch: shorting is dangerous. You can lose more than your initial deposit if the price spikes. And with meme coins, spikes happen every hour.

Telegram Integration: The Secret Weapon

What makes Ebi.xyz stand out isn’t just the trading model - it’s how you access it. It’s the first DEX to fully integrate with Telegram’s HOT Wallet. That means you can create an account, deposit USDT, and start trading - all inside Telegram. No MetaMask. No wallet connect pop-ups. No gas fee headaches. You just open the app, tap "Trade," and go.

This is huge for new users. Telegram has over 800 million active users. Most of them don’t know what a wallet is. But they know how to use Telegram. Ebi.xyz lowers the barrier to entry so much that even people who’ve never held crypto can start trading perpetuals. That’s why it exploded in late 2024. The Hamster Kombat community - a Telegram game with over 125,000 YouTube subscribers - pushed Ebi.xyz as the place to cash out your $HOT tokens. And you didn’t need KYC to do it.

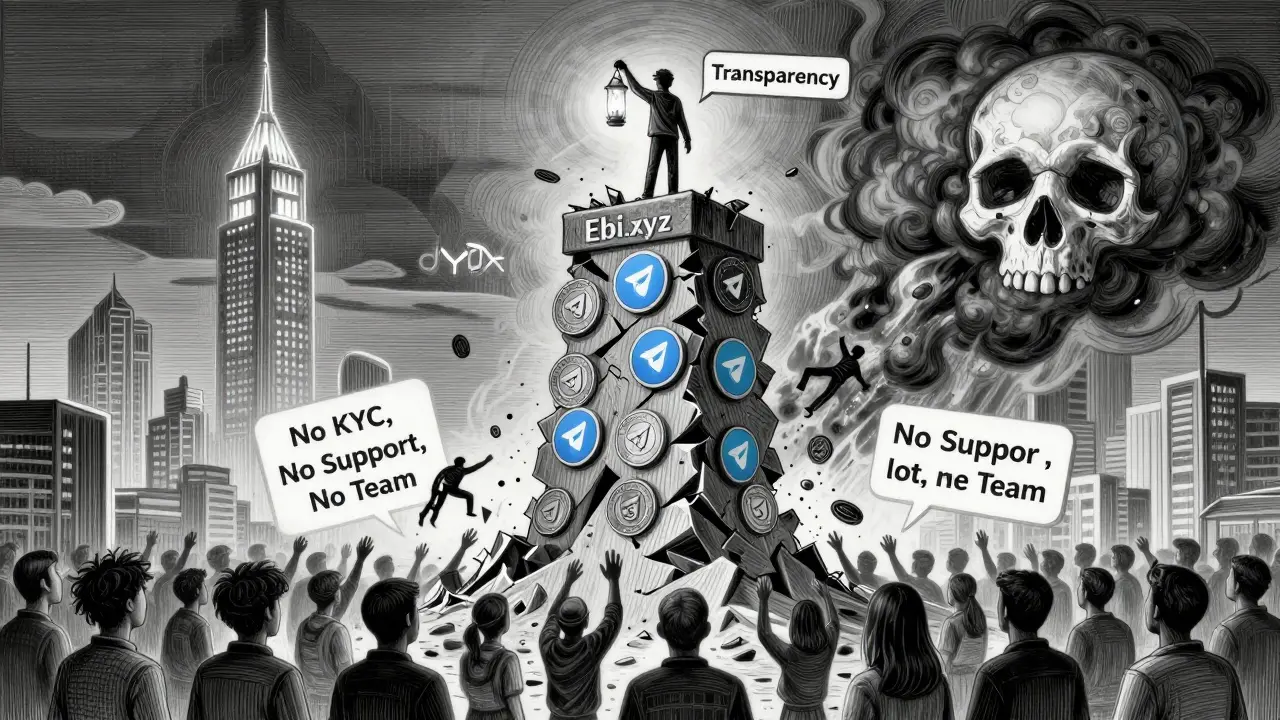

Red Flags: Who’s Behind Ebi.xyz?

But here’s where things get scary. The owner of ebi.xyz is hidden. The WHOIS record shows domain privacy enabled. That’s not illegal. But in crypto, it’s a major red flag. Legitimate projects like Uniswap, dYdX, and GMX have public teams. They post updates on Twitter. They answer questions. Ebi.xyz doesn’t. There’s no team page. No LinkedIn profiles. No GitHub commits.

ScamAdviser gives the site a "very low trust score," calling it a possible scam. Gridinsoft flagged it as potential malware. That’s not something you ignore. On the flip side, DNSFilter says the site is safe, and the SSL certificate is valid. So it’s not hacked. But that doesn’t mean it’s trustworthy. A site can be technically secure and still be a rug pull waiting to happen.

Traders Union, a review platform that tracks crypto exchanges, gave Ebi.xyz a 0.7 out of 5. Their report cited "poor user feedback, low engagement, and unresolved customer complaints." That’s not a minor critique. That’s a death sentence for any financial platform. If users are losing money and can’t get help, it’s not innovation - it’s neglect.

Who Is This For? Who Should Stay Away?

Ebi.xyz isn’t for everyone. It’s not for beginners who don’t know what leverage is. It’s not for people who want to hold Bitcoin long-term. It’s not for traders who need customer support when things go wrong.

It’s for one kind of person: experienced meme coin traders who understand the risks of shorting, who are comfortable with Telegram, and who are okay with zero transparency. If you’ve lost money on Pump.fun tokens and want to turn the tables, Ebi.xyz gives you a weapon. But you’re the only one holding the trigger.

Compare it to dYdX. That platform has processed over $1.2 trillion in trading volume since 2017. It’s regulated in some jurisdictions. It has a known team. Ebi.xyz? Three years old. No team. No public roadmap. Just a website and a partnership with a viral Telegram game.

The Bigger Picture: Is This the Future?

Ebi.xyz taps into three massive trends: Telegram-based finance, meme coin trading, and perpetual futures. All three are growing fast. Meme coin volumes jumped 347% in 2024. Telegram crypto apps grew 300% year-over-year. Perpetuals now make up 42% of all crypto derivatives trading.

So yes, the model works - for now. But history shows that DEXs with less than five years of history have a 78% failure rate, according to Messari’s Q3 2025 report. Ebi.xyz is three years in. That puts it right in the danger zone.

Its biggest threat isn’t competition from Uniswap or GMX. It’s its own lack of accountability. If the team vanishes tomorrow, users won’t be able to withdraw. There’s no insurance. No legal recourse. Just a website that says "trade here" and a promise.

Final Verdict: High Risk, High Reward - But Not Worth It

Ebi.xyz isn’t a scam in the traditional sense. It’s not stealing funds outright. But it’s built on a foundation of secrecy, hype, and user ignorance. The FUD Market is clever. The Telegram integration is brilliant. The growth numbers are real.

But trust isn’t built on viral airdrops or fast user growth. It’s built on transparency, support, and time. Ebi.xyz has none of that. And in crypto, where the line between genius and fraud is paper-thin, that’s enough to make you walk away.

If you’re a seasoned trader who understands the risks and wants to short meme coins - and you’re okay with no safety net - then you might try it. But don’t put in more than you’re willing to lose. And never, ever believe the hype. The platform that doesn’t tell you who’s behind it isn’t building a future. It’s building a gamble.

Is Ebi.xyz safe to use?

Ebi.xyz has a valid SSL certificate and isn’t currently hacked, but it has a very low trust score from security tools like ScamAdviser and Gridinsoft. The team is anonymous, there’s no public support, and user reviews are overwhelmingly negative. It’s technically safe to access, but financially risky. Treat it like gambling, not investing.

Does Ebi.xyz require KYC?

No, Ebi.xyz does not require KYC for trading or for redeeming Hamster Kombat airdrops. This makes it attractive to privacy-focused users, but it also means you’re trading in a completely unregulated space. That could lead to future legal issues if regulators crack down on unlicensed derivatives platforms.

Can I withdraw my funds from Ebi.xyz anytime?

Technically, yes - because it’s non-custodial, your funds stay in your wallet. But if the platform goes offline, shuts down, or the smart contracts have a flaw, you might not be able to access your assets. There’s no backup, no customer service, and no guarantee the system will keep running. Your funds are only as safe as the code and the team behind it - and neither is transparent.

How does Ebi.xyz compare to dYdX or Uniswap?

dYdX and Uniswap have years of history, verified teams, massive liquidity, and clear regulatory positions. Ebi.xyz has no team, minimal liquidity, and operates in a legal gray zone. dYdX handles billions in monthly volume. Ebi.xyz’s peak was 145,000 new users in a week - impressive, but tiny in comparison. If you want reliability, go with the established players. Ebi.xyz is only for high-risk, niche trading.

Is the FUD Market worth using?

The FUD Market is clever - it lets you profit when meme coins crash, which happens often. But it’s also extremely risky. Perpetuals use leverage, and meme coins can swing 50% in minutes. You can lose your entire deposit - or more - very quickly. Only use it if you fully understand how shorting works, have a strict stop-loss strategy, and are prepared to lose everything.

Why is Ebi.xyz so popular on Telegram?

Because it’s easy. You don’t need to learn wallets or gas fees. You just open Telegram, connect your HOT Wallet, and trade. Add in exclusive airdrops from Hamster Kombat, and it becomes a viral loop: play a game, earn tokens, trade them, earn more. It’s designed for mass adoption - but not for safety or sustainability.

Should I invest in Ebi.xyz’s token?

There is no Ebi.xyz token. The platform doesn’t have a native token. Any claims about an "EBI token" are scams or misinformation. Ebi.xyz operates using USDT and other stablecoins. Be extremely wary of anyone selling you a token tied to this exchange - it’s not real.

Ebi.xyz is wild, but honestly? It’s the future of crypto for people who don’t want to deal with MetaMask or gas fees. I’ve seen new users on Telegram trade $HOT tokens in under 2 minutes. No KYC, no headaches. Sure, it’s risky-but so is buying Dogecoin on a whim. At least this gives you a way to profit when the hype dies. The FUD Market is genius. If you know what you’re doing, it’s the only smart play in meme coin chaos.

lol this site is a scam waiting to happen. no team no verif no nothing. u think its cool bc u can trade in telegram? bro its a phishing trap. i seen 3 people lose everything last month. they thought it was legit. its not. its a rug pull with a nice ui. dont touch it. ever. its a trap.

From India, I’ve been watching this platform for months. The Telegram integration is insane-no one here knows how to use wallets, but everyone uses Telegram. Ebi.xyz is basically giving them a gateway into DeFi without the learning curve. Yeah, it’s risky, but so is buying lottery tickets. The fact that it’s non-custodial means your funds aren’t stolen unless you get phished. And honestly? If you’re shorting meme coins, you already know the game. Just don’t leverage more than you can afford to lose. The FUD Market is clever, not evil.

Let’s be clear: this isn’t innovation. It’s exploitation. You’re catering to the lowest common denominator-the people who think crypto is a casino and Telegram is their broker. dYdX has institutional liquidity. Ebi.xyz has a viral game and a domain registered under privacy. That’s not a DEX. That’s a Ponzi with better UX. And don’t tell me ‘it’s non-custodial’-if the smart contract has a backdoor, your ‘keys’ are just a placebo. This is crypto’s equivalent of selling candy to kids and calling it nutrition.

There’s a philosophical irony here: Ebi.xyz democratizes access to derivatives by removing barriers, yet simultaneously obfuscates accountability. The absence of a public team isn’t merely an aesthetic choice-it’s an ontological void. In a system predicated on trustless computation, the human element remains the ultimate vulnerability. The platform’s success hinges on the paradox that users willingly surrender epistemic security for operational convenience. This is not finance. It is ritualized risk enacted through UI design. And like all rituals, it only holds power so long as belief persists.

They’re using Hamster Kombat to launder attention. You think this is about trading? Nah. It’s a psyop. The ‘FUD Market’ is just a distraction so they can quietly drain liquidity from the wallets of people who think they’re smart. I’ve seen the same pattern with every ‘new’ crypto platform-viral hype, anonymous devs, then poof. The SSL cert? That’s just the shiny wrapper. The real scam is making people feel like they’re in control when they’re just feeding the machine.

I tried it. Just $50. Used the Telegram bot. Made a few short trades. Lost $12, then got lucky and doubled it. Walked away. Honestly? It felt like playing poker in a basement with no rules. No customer service. No help. But the interface? Smooth. Fast. No lag. If you treat it like a slot machine and never go all-in, it’s fine. Just don’t tell your grandma about it.

Anyone using this is an idiot. No KYC? No team? You’re not trading-you’re volunteering to be the next rug pull statistic. This isn’t innovation. It’s criminal negligence wrapped in a TikTok UI. And the fact that people call it ‘brilliant’ just proves how far we’ve fallen.