GDOGE Reward Calculator

Based on real GDOGE project data:

Daily trading volume: $8.28 | Total supply: 100 quadrillion tokens

Transaction fee: 10% (5% buy, 5% sell)

GDOGE was never a success story. It was a math problem dressed up as a crypto opportunity - a token with 100 quadrillion supply, a promise of daily BNB rewards, and a listing on CoinMarketCap that made it look real. But behind the shiny name and the fancy website, there was nothing. No community. No development. No value. Just a ghost of a project that tricked people into thinking they could get rich from a meme coin that didn’t even work.

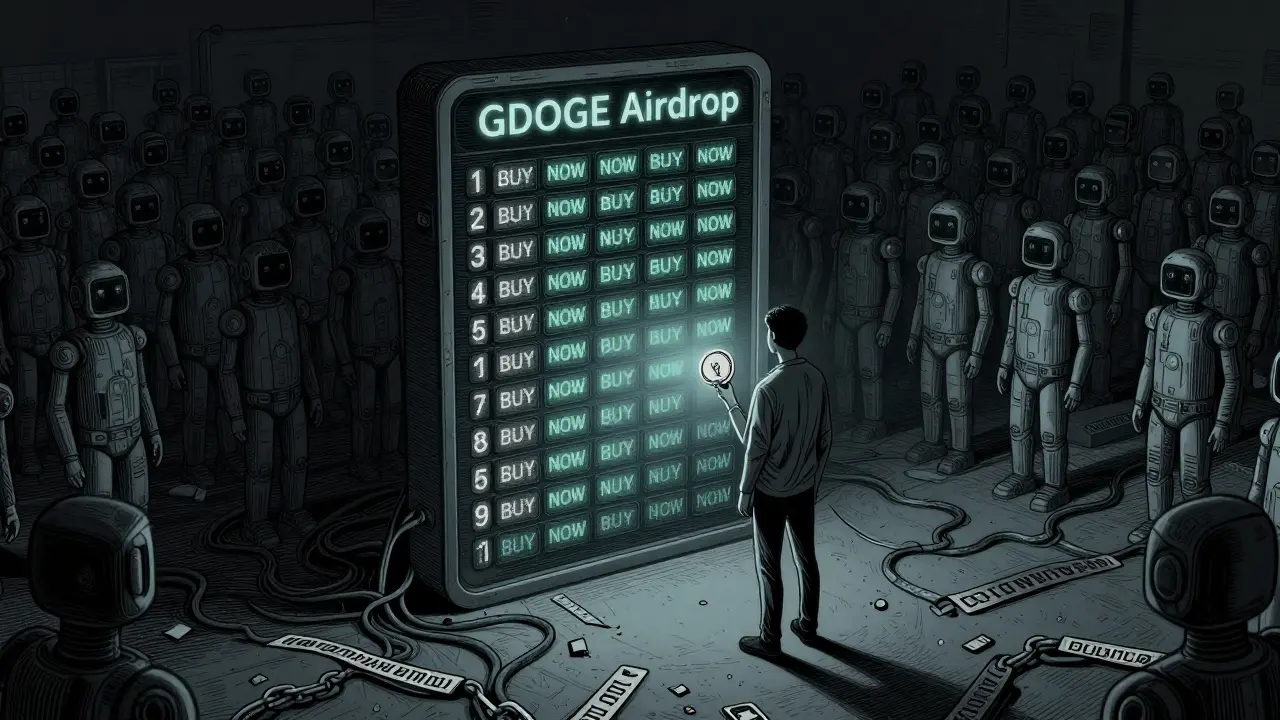

What Was the GDOGE Airdrop?

The Golden Doge (GDOGE) airdrop promised free tokens to early supporters. According to the project’s original plan, 5% of the total supply - that’s 5 quadrillion GDOGE tokens - was set aside for community airdrops. People were told to join Telegram, follow Twitter, and hold tokens to qualify. But here’s the truth: no one ever received meaningful value from it. The airdrop wasn’t a reward. It was a distribution tactic. The team dumped tokens into wallets, hoping people would buy in, trade them, and generate transaction fees. Those fees were supposed to fund the so-called “Golden Vault,” a smart contract that would send BNB back to holders. But with almost no trading, the vault stayed empty. You couldn’t earn rewards because there was no volume to generate them. Even if you held 1 million GDOGE tokens - a huge amount for a meme coin - you’d get about $0.000003 in BNB per day. That’s less than a fraction of a cent. And you had to pay gas fees just to claim it. Most users ended up losing money.Why Was GDOGE Listed on CoinMarketCap?

CoinMarketCap doesn’t verify projects. It doesn’t check if a token has a team, a roadmap, or even active users. It only checks basic technical requirements: a blockchain address, a supply number, and some trading activity. GDOGE met those minimums. That’s it. The listing didn’t mean legitimacy. It meant visibility. And that’s exactly what the team wanted. A CoinMarketCap page gave the illusion of credibility. People saw the listing, thought, “If it’s on CoinMarketCap, it must be real,” and bought in. But CoinMarketCap’s own documentation labeled GDOGE as a “preview page” - Tier 4, the lowest possible classification. That’s the same tier given to hundreds of abandoned tokens. It’s not a stamp of approval. It’s a warning label.The Golden Vault: A Promise That Never Delivered

The biggest lure of GDOGE was the 10% transaction fee - 5% on buys, 5% on sells - supposedly redistributed to holders as BNB. The idea sounded like passive income. But it only worked if people were trading. On October 19, 2025, GDOGE’s 24-hour trading volume was $8.28. That’s less than the cost of a coffee. With that little activity, the Golden Vault collected almost nothing. Even if you held 1% of all GDOGE tokens - which would require owning 1 quadrillion tokens - you’d still earn less than $0.01 per day. And here’s the catch: to earn $1 a day in BNB rewards, you’d need to hold 333 quadrillion GDOGE tokens. But the total supply is only 100 quadrillion. That’s mathematically impossible. The system was designed to fail. It wasn’t broken. It was built to fail.

Why GDOGE Failed When Other Meme Coins Survived

Dogecoin and Shiba Inu have massive communities, real use cases, and millions of daily trades. GDOGE had none of that. It had a website with broken links, a GitHub repo last updated in 2023, and a Telegram group where 98% of messages were bots. Other meme coins burned supply to create scarcity. GDOGE doubled down on inflation. A 100 quadrillion supply means each token is worth almost nothing. At its peak, GDOGE traded at $0.000000000000000003. That’s 3 quintillionths of a dollar. You’d need to hold 333 trillion tokens just to make $1. Compare that to Dogecoin, which trades at $0.06 with a market cap of $13.5 billion. GDOGE’s market cap? Effectively zero. Its trading volume? Lower than the gas fees people spent trying to sell it.What Users Actually Experienced

Real people tried this. They didn’t just read about it - they invested time, money, and hope. One Reddit user, CryptoRealist2025, held 500 billion GDOGE for a month. He claimed BNB rewards daily. At the end, he earned $0.00006 total. He spent $0.15 in gas fees. He lost money. Another user, DisappointedInvestor, left a Trustpilot review: “The Golden Vault is empty. No transactions mean no rewards. Classic rug pull.” On Telegram, users asked questions. No one answered. The channel had over 2,300 members, but only 3 real messages per day. The rest were bots repeating “BUY NOW” or “REWARD CLAIMING OPEN.” The most heartbreaking story came from Bitcointalk. A user tried to sell 20 quadrillion GDOGE tokens. The price was so low, he paid $127 in gas fees just to make the transaction. When it finally went through, the tokens were worthless. He lost $127 trying to get out.

The Project Is Dead. Here’s the Proof.

Golden Doge hasn’t been updated since mid-2023. The official Twitter account went silent in February 2024. The last tweet said “major updates coming soon.” They never came. The planned Golden Crypto Lottery? Never built. The NFT game? No code. The decentralized exchange (Golden Crypto Swap)? Zero liquidity. No one uses it. BscScan shows the contract hasn’t changed since June 14, 2023. No new features. No bug fixes. No marketing. No team updates. Just silence. CoinGecko classifies GDOGE as “inactive.” Messari says it’s one of 1,287 zombie tokens - projects with listings but no life. Blockworks gave it an “F” for risk. The U.S. SEC’s 2024 meme coin guidance specifically warned about tokens like this - those with redistribution rewards and massive supply.Should You Ever Invest in a Token Like GDOGE?

No. If you see a token with:- A supply over 1 quadrillion

- A “reward system” that depends on trading volume

- A CoinMarketCap listing but no exchange support (no Coinbase, no Binance)

- A website with broken links and no GitHub activity

- Community silence and bot-filled Telegram channels

What to Do If You Still Hold GDOGE

If you own GDOGE right now, here’s what you need to know:- Don’t spend more gas trying to claim rewards. You’ll lose money.

- Don’t buy more. There’s no upside.

- If you can sell it for any amount, even $0.000001 per token - do it. At least recover your gas fees.

- Forget the Golden Vault. It’s empty.

- Don’t trust any “new update” announcements. They’re fake.

Was the GDOGE airdrop real?

Yes, the airdrop happened technically - 5 quadrillion GDOGE tokens were distributed. But it wasn’t a gift. It was a tactic to get people to buy, trade, and generate fees. No one received meaningful value. The rewards system was designed to fail, and most users lost money trying to claim tiny BNB amounts.

Why is GDOGE on CoinMarketCap if it’s worthless?

CoinMarketCap lists tokens based on basic technical criteria, not quality. GDOGE had a blockchain address, a supply number, and minimal trading volume - enough to meet their lowest listing tier (Tier 4). The listing doesn’t mean it’s safe, legitimate, or valuable. It just means it’s visible.

Can I still earn BNB rewards from GDOGE?

Technically, yes - you can claim rewards through the smart contract. But with only $8.28 in daily trading volume, the Golden Vault collects almost nothing. Even if you hold millions of tokens, you’ll earn fractions of a cent. The gas fees to claim are higher than the reward. It’s not worth it.

Is GDOGE a scam?

It’s not a scam in the traditional sense - no one stole your funds directly. But it’s a classic pump-and-dump disguised as a reward system. The team created a token with impossible economics, listed it, attracted buyers, then vanished. No updates. No development. No community. That’s the definition of an abandoned project with deceptive marketing.

What happened to the Golden Doge team?

They disappeared. The official Twitter account hasn’t posted since February 2024. The website is archived with broken links. The GitHub repo hasn’t been updated since 2023. No team members have been identified. The project was likely created by anonymous developers who launched it, collected initial funds, and walked away.

Should I buy GDOGE now?

No. GDOGE has no future. The token is inactive, the ecosystem is dead, and there’s zero chance of recovery. Buying it now won’t make you money - it will only cost you gas fees. Treat it like a digital relic, not an investment.