When you’re looking to buy, sell, or trade cryptocurrency, the exchange you choose makes all the difference. Not all platforms are built the same. Some are simple for beginners. Others are built for traders who need speed, low fees, and deep markets. And then there’s Krypto - a name that pops up in searches but doesn’t show up on most top lists in 2026. So, is Krypto a real player, or just another confusing option in a crowded field?

Let’s cut through the noise. If you’re asking about Krypto as a crypto exchange, you’re likely hearing about it from a friend, an ad, or a YouTube video promising low fees or fast trades. But here’s the hard truth: Krypto isn’t one of the major exchanges like Coinbase, Kraken, or Crypto.com. In fact, there’s no widely recognized, regulated exchange by that exact name operating in the U.S. as of February 2026. What you’re probably seeing is either a small, unregulated platform, a rebranded service, or a scam site mimicking legitimate names.

What Is Krypto (Really)?

The term "Krypto" is often used as a generic word for cryptocurrency - like saying "net" for internet. But when someone says "Krypto crypto exchange," they usually mean one of two things:

- A small, offshore exchange using "Krypto" in its branding - often with no clear ownership or regulatory status.

- A phishing site or clone of a real exchange (like Kraken or Crypto.com) trying to steal login details or private keys.

There’s no verified entity called "Krypto Exchange" registered with the U.S. Financial Crimes Enforcement Network (FinCEN) or licensed in any U.S. state. Major watchdogs like the SEC and CFTC haven’t listed any exchange under that name. Even blockchain analytics firms like Chainalysis and Elliptic don’t track any legitimate platform called Krypto with significant trading volume.

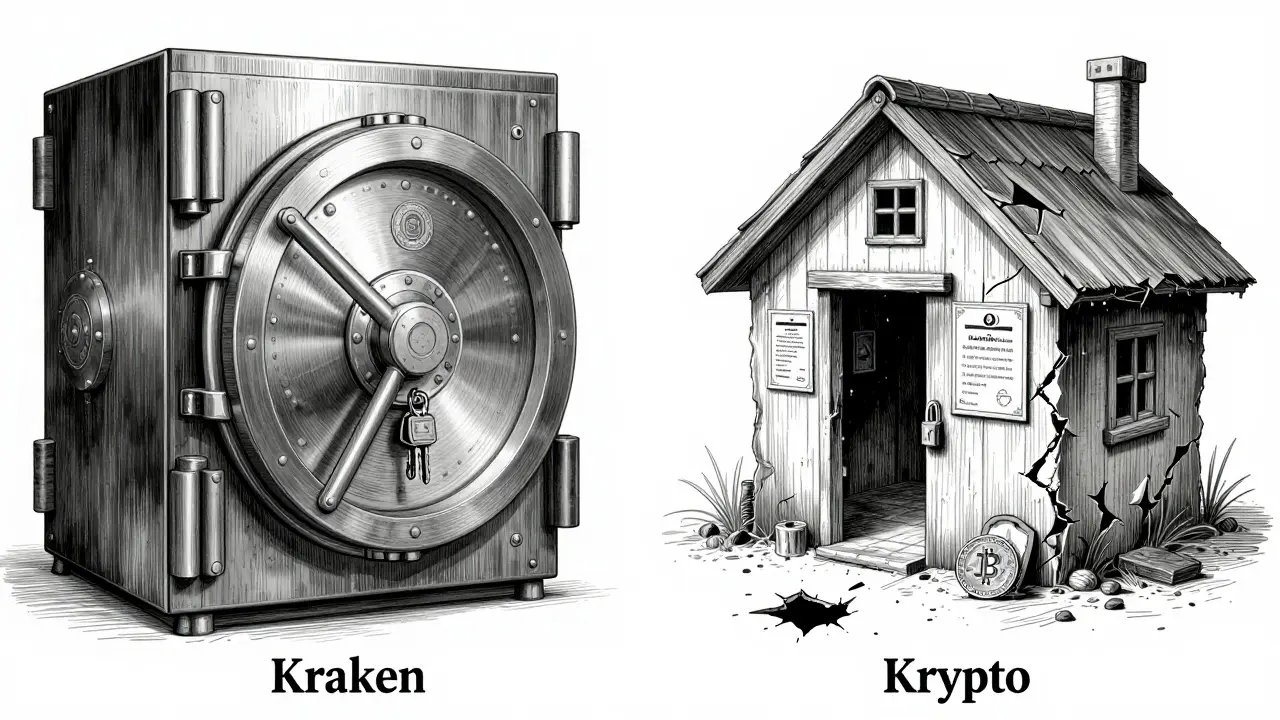

Compare that to Kraken - a real, regulated exchange founded in 2011, with $15+ billion in monthly volume, 95% of assets in cold storage, and licenses across all 50 U.S. states. Or Coinbase, which handles over $50 billion in quarterly trades and has 55 million verified users. These are names with history, transparency, and accountability. Krypto? It has none of that.

Why People Get Confused

It’s not your fault you’re confused. The crypto space is full of names that sound similar:

- Kraken - legitimate, regulated, trusted

- Krypto - ambiguous, unverified, risky

- Crypto.com - real, massive marketing, but high hidden spreads

- Kryptex, KryptoPay, KryptoWallet - all unrelated, often sketchy

Google searches for "Krypto exchange" return a mix of scam sites, affiliate links, and outdated forum posts from 2021. YouTube videos promoting "Krypto" often use stock footage of trading charts and fake testimonials. One video with 200,000 views showed a "Krypto app" that was actually a clone of a 2020 version of Crypto.com’s old interface - with no connection to the real company.

Even Reddit threads like r/CryptoCurrency have multiple posts from users asking, "Is Krypto safe?" - only to be answered by experienced traders: "Don’t use it. It’s not real. Check the domain. If it’s not krx.com or kraken.com, walk away."

Red Flags to Watch For

If you’re being pushed toward "Krypto," here are the five biggest warning signs:

- No official website with clear legal info - Legitimate exchanges list their company registration, physical address, and regulatory licenses. Krypto sites rarely do.

- Unusual domain names - If the URL is krypto-exchange.net, kryptoapp.io, or krypto-coin.xyz, it’s not real. Real exchanges use clean domains like kraken.com or coinbase.com.

- Promises of "zero fees" or "10x returns" - No exchange gives you free trading and guaranteed profits. That’s how scams start.

- Pressure to deposit quickly - "Limited time offer," "Your account will be locked," or "Only 3 spots left" - these are classic phishing tactics.

- No phone support or live chat - Even small legit exchanges offer at least email or chat support. Krypto sites often have zero contact options.

One user in Texas lost $8,400 in ETH after signing up on a site called "KryptoHub" in November 2025. The site disappeared two days later. The wallet address used for deposits was traced to a known money mule account linked to a Russian cybercrime ring. That’s not an outlier - it’s the norm.

What Should You Use Instead?

If you want a safe, reliable exchange in 2026, here are the real options - no guessing required.

Best for Beginners: Coinbase

Coinbase is the easiest place to start. It’s got a clean app, step-by-step guides, and educational quizzes before you can trade. You can buy Bitcoin with a bank transfer or debit card. Fees are clear: 0.5% for bank transfers, up to 3.99% for cards. It supports 235 cryptocurrencies and is licensed in 43 U.S. states. It’s not the cheapest for heavy trading, but it’s the safest for new users.

Best for Traders: Kraken

If you’re serious about trading, Kraken is the top pick. It has the deepest order books, lowest fees (as low as 0% for makers), and 99.9% uptime since 2024. It offers advanced tools like limit orders, stop-losses, futures with 50x leverage, and even an OTC desk for trades over $100,000. Its verification process takes 2-3 days, but once you’re in, you get phone support and full transparency on fees. Kraken also publishes weekly proof-of-reserves reports - meaning you can verify they actually hold your coins.

Best for Rewards: Crypto.com

Crypto.com is the only major exchange that gives you cashback on a Visa card (up to 8%) and lets you stake over 250 coins. But here’s the catch: their spot trading spreads are hidden. Independent tests show you pay 3%+ more than market price just to buy Bitcoin. So if you’re not using the card or staking, you’re losing money on every trade.

Best for Staking: Uphold

Uphold lets you convert between 5,000+ assets - like turning Bitcoin into gold or Ethereum into euros - in one click. It offers staking rewards up to 10% APY on 50+ coins. But it’s slow to respond to support tickets (72+ hours average), and you can’t withdraw under $50 in crypto. It’s great if you want flexibility, but not for quick trades.

How to Stay Safe

Here’s a simple checklist before you deposit any money:

- Check the domain - is it .com, .org, or .io? Avoid .xyz, .net, or .club.

- Search for the exchange on CryptoCompare or CoinGecko - if it’s not listed, skip it.

- Look up the company on FinCEN’s database - only registered entities are legal in the U.S.

- Read recent reviews on Trustpilot and Reddit - not the homepage testimonials.

- Never use a link from an email, DM, or YouTube ad. Always type the URL yourself.

There’s no shortcut to safety. If a platform sounds too good to be true - low fees, high rewards, no KYC - it is.

Final Verdict: Skip Krypto

Krypto isn’t a crypto exchange. At least, not a real one. It’s a name used by scammers, copycats, and shady affiliates to trick people into giving up their private keys or funds. There’s no official team, no regulatory oversight, no transparency, and no track record.

Stick with the big names - Coinbase, Kraken, Crypto.com, or Uphold - depending on your needs. They’ve been tested, audited, and trusted by millions. And if you’re still unsure, start with Coinbase. It’s the easiest, safest, and most straightforward path into crypto.

Don’t gamble with your crypto on a name you can’t verify. The market is risky enough without adding fake exchanges to the mix.

Is Krypto a real crypto exchange?

No, Krypto is not a real, regulated crypto exchange as of 2026. There is no verified platform by that name operating legally in the U.S. or major global markets. It’s often used by scam sites to mimic legitimate exchanges like Kraken or Crypto.com. Always verify the domain and check regulatory listings before using any platform.

Why do people confuse Krypto with Kraken?

The names sound nearly identical, and many scam sites use "Krypto" to trick users into thinking they’re on Kraken. Kraken (kraken.com) is a legitimate, regulated exchange with over $15 billion in monthly volume and 95% cold storage. Krypto has no official presence, no regulatory licenses, and no public leadership. Always double-check the URL - one letter can cost you everything.

Can I trust Krypto’s mobile app?

No. There is no official Krypto mobile app. Any app claiming to be "Krypto Exchange" on the App Store or Google Play is fake. These apps are designed to steal your login credentials or private keys. Legitimate exchanges like Coinbase and Kraken have verified apps with millions of downloads and clear developer info. Never download an app from a link - only use official app stores and search for the exact name.

What should I do if I already deposited money on Krypto?

Stop using the site immediately. Do not send more funds. Try to withdraw any remaining balance - but don’t expect it to arrive. Report the site to the FTC at reportfraud.ftc.gov and to your bank or credit card company. If you sent crypto, the transaction is irreversible. Learn from this: always verify an exchange’s legitimacy before depositing. Use trusted platforms with public records and regulatory compliance.

Are there any legitimate exchanges with "Krypto" in the name?

No. While some small, unregulated platforms may use "Krypto" in their branding (like KryptoPay or KryptoWallet), none are recognized by regulators, auditors, or major industry reports. Even if they claim to be based overseas, they still pose high risk. The only safe exchanges are those with clear legal status, published audits, and transparent leadership - like Kraken, Coinbase, or Binance.US.

Let me guess - you found Krypto through a YouTube ad with a guy in a suit saying "10x your money in 7 days"? 🤡 I saw the same thing last week. The site looked legit until I checked the domain - krypto-exchange[.]xyz. No SSL cert, no WHOIS info, and the "support email" bounced. I reported it to CryptoScamDB. If you're dumb enough to deposit, you deserve to lose it. Just saying.

As someone who’s worked in fintech compliance for over a decade, I can tell you this isn’t just about scams - it’s about systemic erosion of trust. Krypto isn’t a typo for Kraken; it’s a *deliberate* mimicry tactic. These actors rely on cognitive fluency - making fake names sound familiar so your brain skips verification. And yes, it works. People lose life savings because they trust the *sound* of a name, not the legal structure behind it. This isn’t negligence - it’s predation, and regulators are asleep at the wheel.

Ugh. Another post telling people not to use something that doesn’t exist? Wow. Groundbreaking. I’m sure the 3 people who stumbled on Krypto by accident are now sobbing in their cubicles. Meanwhile, real problems like Coinbase’s 5% card fee or Kraken’s 3-day KYC hell go ignored. Maybe instead of fearmongering about ghost exchanges, someone should fix the ones that actually suck?

As someone who grew up in Nigeria where "crypto" was the only way out of hyperinflation, I’ve seen how names get twisted. In Lagos, we had "BitKrypto" - sounded like Bitcoin + Krypto, but it was run by a guy in a garage with a fake license. We called it "the ghost wallet." People lost everything. So when I see "Krypto" pop up in U.S. searches? I cringe. It’s not just a scam - it’s a cultural echo of how vulnerable people are when they’re desperate. Please, if you’re new, start with Coinbase. No exceptions.

STOP. JUST STOP. I’ve been trading since 2017. I’ve lost money. I’ve won big. But I’ve NEVER lost money because I didn’t check a domain. If you’re putting money into "Krypto" - you’re not ready. Not even a little. Go to Coinbase. Buy $5 of BTC. Learn how the wallet works. Then come back. This isn’t gambling - it’s basic hygiene. And if you can’t do basic hygiene? Don’t touch crypto. Period.

So… are we sure Krypto isn’t a CIA black project? 😏 I mean, think about it - why would *every* legitimate exchange avoid the name? Why no press releases? No LinkedIn? No team photos? It’s too perfect. Maybe it’s a honeypot. Maybe the government is luring scammers into a fake exchange so they can trace their wallets… or maybe they’re using it to track *us*. 🤔 I’m not saying it’s real… but I’m not saying it’s fake either. 🕵️♀️👀

It is imperative to underscore the ontological fallacy inherent in the conflation of phonological proximity with institutional legitimacy. The lexical similarity between "Krypto" and "Kraken" constitutes a semiotic hijacking, wherein perceptual heuristics are weaponized by adversarial actors operating within the metastable regulatory vacuum of decentralized finance. This is not mere phishing - it is epistemological subversion, a deliberate destabilization of trust architecture within the crypto-economic ecosystem. One must therefore invoke the principle of verifiable provenance prior to any transactional engagement.

i just wanted to say i got confused too. i thought krypto was like… a new version of kraken? like a rebrand? i even typed in krypto.com and it took me to some weird site with a 2018 design. i sent $200 and it vanished. i’m so embarrassed. i didn’t even check the url. i just trusted the name. now i’m using coinbase and i feel so dumb. but hey, i learned. don’t be like me. always check. always. even if you’re in a hurry. seriously. 🥲