When you add ETH and USDC to a liquidity pool on Uniswap, you’re not just depositing two tokens-you’re setting up a mathematical contract that determines how prices move, how much you earn, and how much you might lose. The secret behind all of this? Liquidity pool token ratios. These ratios aren’t just numbers. They’re the engine that drives every trade, every fee, and every unexpected loss in decentralized finance.

What Exactly Is a Token Ratio?

A liquidity pool token ratio is the proportion of two tokens held inside a smart contract. For example, in a 50/50 ETH/USDC pool, half the total value is ETH and half is USDC. This ratio isn’t static. It changes every time someone trades. And that change is what creates prices.Most DeFi pools use a formula called x × y = k. Here, x is the amount of one token, y is the amount of the other, and k is a constant. When you swap 100 USDC for ETH, the pool reduces the USDC balance and increases the ETH balance. To keep k the same, the price of ETH must rise. That’s how the pool auto-prices assets-no order books, no middlemen, just math.

This system works because traders and arbitrageurs constantly compare pool prices to outside markets. If ETH is trading for $3,000 on Coinbase but only $2,950 in the pool, someone will buy ETH from the pool and sell it elsewhere until the ratio corrects itself. This keeps pool prices aligned with the real market.

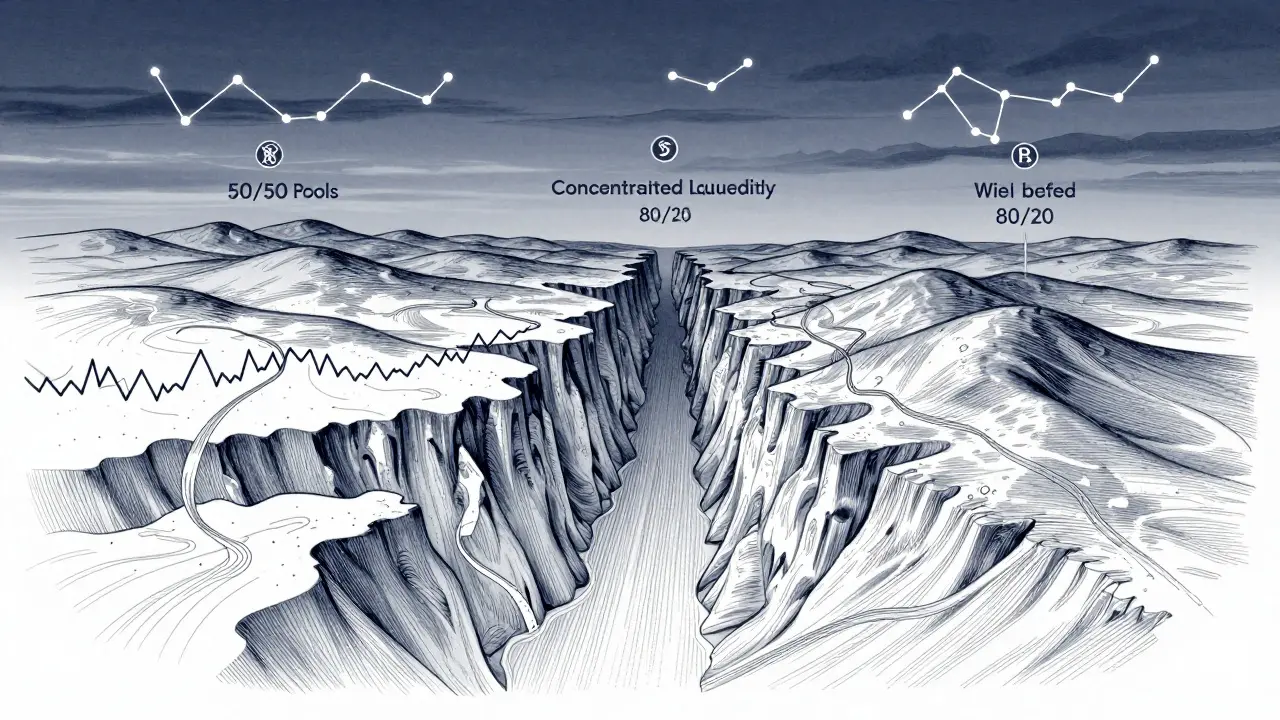

Why 50/50 Isn’t Always the Best Choice

The original Uniswap model forced every pool to be 50/50. But that’s outdated. In 2025, you have options.Take Balancer. It lets you build pools with any ratio: 80/20, 60/30/10, even 95/5. Why? Because not all tokens behave the same. If you’re adding BTC and WBTC to a pool, you don’t need equal amounts-they’re nearly identical in value. A 95/5 split saves capital and reduces risk.

Stablecoin pools like Curve’s USDC/DAI/USDT use a different trick. They’re designed to keep ratios extremely close to 1:1:1. Their algorithm makes tiny price adjustments when one stablecoin dips slightly below $1. This keeps slippage near zero for swaps between stable assets, which is why Curve handles over $1 billion in daily trades.

Then there’s concentrated liquidity-Uniswap v3’s big innovation. Instead of spreading your ETH/USDC across the whole price range, you choose a narrow band, like $2,800 to $3,200. Your capital works harder inside that range. Outside it? Your funds sit idle. This means you earn more fees per dollar deposited, but you risk being completely out of the market if the price moves too far.

How Token Ratios Affect Your Earnings (and Losses)

Liquidity providers earn trading fees. But they also face impermanent loss-the hidden cost of providing liquidity.Imagine you add $1,000 worth of ETH and $1,000 worth of USDC to a 50/50 pool. Later, ETH doubles to $4,000. The pool rebalances. Now, your share has less ETH and more USDC than when you started. Even though ETH went up, your position is worth less than if you’d just held the ETH. That’s impermanent loss.

It’s called “impermanent” because if ETH drops back to $2,000, your loss disappears. But if you withdraw while the price is high, that loss becomes permanent.

Token ratios directly control how bad this gets. In a 50/50 pool, losses grow fast when prices swing. But in an 80/20 pool with mostly stablecoin and a small amount of volatile token, your exposure to price swings is limited. The more you align your ratio with how tokens move together, the less you lose.

Experts at Cyfrin found that pools with highly correlated assets (like USDC and DAI) see 70% less impermanent loss than those with uncorrelated pairs (like ETH and SOL). That’s not luck-it’s ratio design.

LP Tokens: Your Receipt for Pool Ownership

When you deposit into a pool, you don’t get back your original tokens right away. Instead, you get LP tokens-digital proof of your share. If you put in 10% of the total value, you get 10% of the LP tokens.These tokens let you claim your portion of trading fees. They also let you withdraw your original deposit, plus any fees earned. To get your tokens back, you burn the LP tokens. That’s why you can’t trade them like regular crypto. They’re not for speculation-they’re for claiming.

On Ethereum, they’re ERC-20 tokens. On Binance Smart Chain, they’re BEP-20. Their names usually reflect the pair: CAKE-BNB LP on PancakeSwap, or WETH-USDC LP on Uniswap. Always check the contract address before depositing. Fake LP tokens are a common scam.

Choosing the Right Ratio for Your Strategy

Not all pools are built equal. Here’s how to pick wisely:- For beginners: Stick with 50/50 pools of major pairs like ETH/USDC or BTC/USDT. They’re simple, well-tested, and have deep liquidity.

- For stablecoin traders: Use Curve. Its ratio-algorithm minimizes slippage and impermanent loss between stable assets.

- For advanced users: Try concentrated liquidity on Uniswap v3. Set a tight price range around current market value. You’ll earn 3x-5x more fees-but you’ll need to monitor it.

- For portfolio diversification: Use Balancer-style weighted pools. Deposit 70% stablecoin, 20% ETH, 10% SOL. You get exposure without overexposing to one asset.

Always ask: How correlated are these tokens? If one tends to move with the other, you’re safer. If they’re unrelated, expect bigger swings-and bigger losses.

What’s Next for Token Ratios?

The future of liquidity pools is customization. Uniswap v4, launching in early 2026, will let developers build custom logic into pools. Imagine a pool that automatically adjusts its ratio based on volatility, or one that shifts weights when a token’s market cap changes.Some teams are already testing pools that auto-rebalance using oracles. If ETH drops 15%, the pool might shift from 50/50 to 60/40 to protect against further loss. These aren’t sci-fi-they’re live in testnets.

As DeFi grows, liquidity providers will need more control. The days of blindly joining 50/50 pools are ending. The smart money now designs ratios like a portfolio manager-balancing risk, return, and correlation.

Common Mistakes to Avoid

- Ignoring price movement: If ETH spikes 300% and you don’t withdraw, your LP position becomes mostly USDC. You’re no longer benefiting from ETH’s rise.

- Using uncorrelated assets: Putting SOL and USDC together? You’re asking for big impermanent loss. They don’t move together.

- Not checking fees: Some pools have low trading volume. That means low fees. High TVL doesn’t always mean high returns.

- Forgetting gas costs: Rebalancing or moving in/out of concentrated pools costs money. If you’re swapping too often, fees eat your profits.

The best advice? Start small. Deposit $100 into a 50/50 ETH/USDC pool. Watch how the ratio changes after a few trades. See how your LP tokens grow. Then try a concentrated pool. Learn by doing.

What happens if the token ratio in a liquidity pool changes?

The ratio changes automatically every time someone trades. If more ETH is sold into the pool, the amount of ETH increases and USDC decreases. This shifts the price higher. The math behind it (x × y = k) ensures prices adjust smoothly without external feeds. But if the ratio moves too far from the market price, arbitrage traders step in to buy cheap tokens from the pool and sell them elsewhere, bringing the ratio back in line.

Can I lose money even if the price of my token goes up?

Yes. This is called impermanent loss. If you deposit equal values of ETH and USDC into a 50/50 pool, and ETH doubles, the pool rebalances to keep the ratio equal. You end up with less ETH than you started with and more USDC. Even though ETH went up, your total value might be less than if you’d just held ETH. The loss disappears if the price returns to its original level-but if you withdraw while it’s high, it becomes permanent.

Are 80/20 liquidity pools safer than 50/50?

It depends. An 80/20 pool can reduce impermanent loss if one token is stable and the other is volatile. For example, 80% USDC and 20% ETH means your position is mostly protected from ETH’s swings. But if ETH crashes 50%, you still lose 10% of your total value (20% of 50%). It’s not safer overall-it’s just less sensitive to one asset’s movement. Choose based on correlation, not just the numbers.

Do I need to manually rebalance my liquidity pool?

For standard 50/50 pools, no. The protocol handles it automatically. But for concentrated liquidity pools (like Uniswap v3), you must monitor the price range. If the market price moves outside your set range, your funds stop earning fees until you adjust it. Some tools and bots can do this for you, but they cost gas and sometimes fees. Manual rebalancing gives you control but requires active management.

How do I know if a liquidity pool has good fees?

Look at two things: trading volume and total value locked (TVL). A pool with high volume and high TVL usually means more trades and more fees to split. For example, ETH/USDC on Uniswap has over $20 billion in TVL and $1 billion daily volume-that’s a strong sign. A pool with $10 million TVL and $1 million volume might have low fees. Also, check the APR listed on the platform, but remember it can change fast.