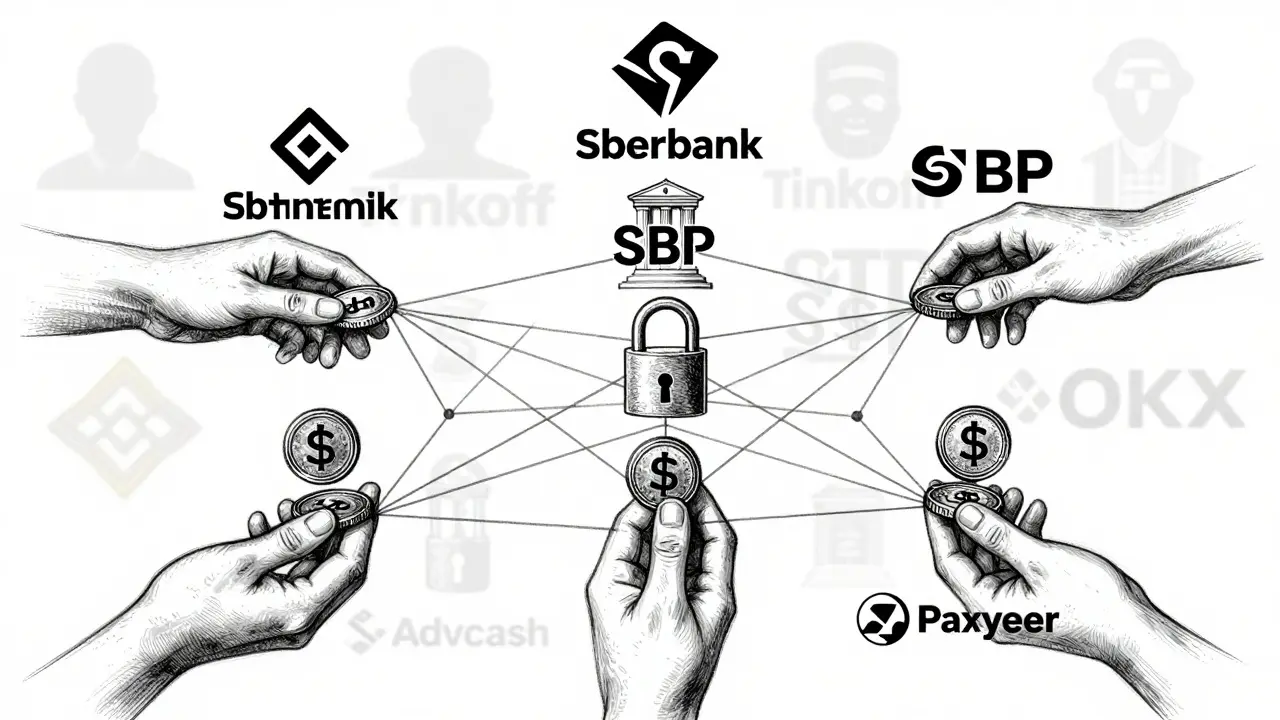

When banks in Russia shut down crypto-related transactions and foreign exchanges pulled out, people didn’t stop trading Bitcoin or USDT-they just moved to P2P. Peer-to-peer crypto trading became the lifeline for millions of Russians who still want to buy or sell digital assets using rubles. No middlemen. No bank approvals. Just direct trades between individuals, powered by platforms that act as escrow and matchmakers. By 2025, this isn’t a workaround-it’s the main way crypto moves in Russia.

Why P2P Is the Only Game in Town

Traditional crypto exchanges like Binance and OKX stopped offering Russian ruble (RUB) trading entirely. Their servers still exist, but if you try to deposit RUB, you’ll hit a wall. The reason? Sanctions, banking restrictions, and unclear regulations from Russia’s Central Bank. Banks began freezing accounts linked to crypto, even if the user wasn’t doing anything illegal. So people turned to P2P platforms-where the trade happens between two people, and the platform just holds the crypto until payment is confirmed. This shift created a new market. In October 2025, Bybit processed over $27 million in RUB trades in just 24 hours. That’s more than the next four platforms combined. MEXC, KuCoin, and Bitget followed, each carving out their own niche. The old rules don’t apply anymore. What matters now is who supports local payment methods, who speaks Russian, and who keeps trading alive.Top Platforms for P2P Crypto in Russia (2025)

- Bybit: The leader. With over 3,800 active ads and full Russian-language support, it’s the go-to for most traders. You can deposit RUB via Sberbank, Tinkoff, Advcash, and even MIR cards. Fees are just 0.1% on spot trades. It also offers futures, staking, and copy trading-all in Russian. Its reputation system is strict: only users with 95%+ completion rates show up as trusted sellers.

- MEXC: The altcoin hub. It supports over 2,800 cryptocurrencies, often listing new tokens within hours of release. Maker fees are zero. Taker fees are just 0.02%. You can deposit RUB through SBP (Russia’s Fast Payment System), Yandex Money, Payeer, and debit cards. Its "Traderfest" program gives free trading on selected pairs, making it popular among traders chasing new projects.

- HTX P2P: Solid volume at $7.6 million daily. Offers 1,350+ ads and supports SBP, bank transfers, and local cards. Not as polished as Bybit, but reliable for large trades.

- Bitget: Licensed in Bulgaria under MiCA rules since February 2025, giving it a legal edge in Europe. Russian users get full localization, 0.1% spot fees, and 0.02% maker fees on futures. Supports up to 125x leverage. Pay with BGB tokens for discounts.

- KuCoin: Offers 900+ coins with 0.1% fees, but only accepts RUB via credit and debit cards. No bank transfers or SBP. That limits its appeal, but it’s still used for quick, small trades.

Notice what’s missing? Binance and OKX. Both have zero RUB activity. Gate.io is also strong, supporting 3,600+ coins and SBP deposits, but it doesn’t have the same volume as Bybit or MEXC. The market is now dominated by platforms that adapted-by localizing, accepting Russian payment systems, and staying under the regulatory radar.

How P2P Trading Actually Works

It’s not as simple as clicking "Buy Bitcoin." Here’s the real process:- You first buy USDT (Tether) using a credit card or bank transfer on the exchange’s spot market. Most users do this because USDT is the most liquid stablecoin in Russia.

- You go to the P2P section and select "Sell USDT for RUB."

- The platform shows you a list of buyers. Each has a reputation score, number of completed trades, and response time.

- You pick a buyer with a 98%+ completion rate and check their payment method. Payment types are color-coded: green = Sberbank, yellow = Tinkoff (now T-Bank), blue = Raiffeisen, red = OZON Bank.

- You click "Trade," the platform locks your USDT in escrow.

- You send the rubles to the buyer’s bank account using the exact method they listed.

- You click "Payment Sent." The buyer confirms receipt. Then the platform releases your USDT to them, and the trade is done.

There’s no human customer service during the trade. Everything is automated. If the buyer doesn’t pay, you file a dispute. The platform reviews screenshots of the bank transfer and decides. Most disputes are resolved in under 24 hours.

The Hidden Risks No One Talks About

Trading P2P sounds safe, but the risks are real-and they’re getting worse.- Counterparty risk: Someone might send you a fake bank receipt. Or they might pay, then claim they never did. That’s why you only trade with users who have 100+ completed trades and 97%+ ratings. One bad trade can wipe out your profits.

- Bank account freezes: Russian banks are trained to flag crypto-related payments. Even if you’re just selling USDT for rubles, your account might get locked for 30 days. Some users report their Sberbank cards being blocked after just one P2P trade. There’s no appeal process.

- Price swings: Crypto moves fast. You list a trade at $1 = 90 RUB. While you wait for the buyer to pay, the price drops to $1 = 87 RUB. You still have to deliver the crypto. You lose 3 rubles per dollar. That’s a 3.3% loss on a single trade.

- Platform risk: What if Bybit gets blocked tomorrow? Or MEXC freezes withdrawals? There’s no government protection. If the platform goes down, your money is stuck.

- Scams: Fake support agents. Phishing links disguised as login pages. Telegram groups offering "guaranteed buyers"-they steal your crypto and vanish. Always use the official app or website. Never click links from Telegram or VK.

And here’s the quietest danger: legal gray zones. Russia doesn’t ban crypto. But it doesn’t officially recognize it either. If you’re audited, you can’t prove your crypto came from a legal source. The Central Bank could demand proof of income. No receipts? You’re on your own.

How to Stay Safe

If you’re trading P2P in Russia, treat it like a high-stakes game. Here’s how to play it smart:- Use two-factor authentication (2FA) on every platform. No exceptions.

- Only trade with users who have at least 100 completed trades and a 97%+ completion rate.

- Never accept payments from accounts that don’t match the buyer’s profile name. If the name on the bank account is "Ivan Petrov" but the trader’s username is "CryptoKing2025," walk away.

- Use SBP for instant transfers. It’s faster and harder to dispute than bank transfers.

- Keep trade screenshots. Save every payment receipt, chat log, and order ID. You’ll need them if there’s a dispute.

- Don’t trade more than you can afford to lose. One frozen account or bad buyer can cost you thousands.

- Use a separate bank account just for crypto. Don’t link your salary account to P2P.

Some traders use Bitget Wallet or MEXC Wallet to store their crypto. These wallets let you buy RUB directly inside the app-no need to go to P2P at all. It’s a newer feature, but it’s growing fast. It’s safer because the whole flow is internal, with fewer touchpoints for fraud.

What’s Next for P2P in Russia?

The market is maturing. Platforms are adding DeFi tools, staking, and automated bots. More users are learning to hedge against price drops with limit orders. Some are even using P2P to pay for freelance work-buying USDT, then sending it to freelancers abroad. But the big question is: how long can this last? Russia’s Ministry of Finance is working on new crypto rules expected in 2026. They might require all P2P platforms to register as financial institutions. That could mean stricter KYC, lower limits, or even bans on certain payment methods. For now, P2P is the only thing keeping crypto alive in Russia. It’s messy. It’s risky. But it works. And until the government gives people a legal, bank-backed way to trade crypto, this system won’t disappear.Final Thoughts

P2P crypto trading in Russia isn’t glamorous. It’s not for beginners. But for those who need to convert crypto to rubles, it’s the only option left. The platforms that survived did so by listening to users-not regulators. They localized, they adapted payment methods, and they kept trading open. If you’re entering this space, go slow. Learn the ropes. Stick to the top platforms. Watch your risks. And never trust anyone who promises "guaranteed profits" or "100% safe trades." In Russia’s crypto world, the only guarantee is that nothing is guaranteed.Is P2P crypto trading legal in Russia?

P2P crypto trading isn’t officially banned in Russia, but it’s not officially legal either. The Central Bank doesn’t recognize cryptocurrencies as money, and banks are instructed to block transactions tied to crypto. Trading on P2P platforms operates in a gray zone. As long as you’re not laundering money or evading taxes, most people aren’t targeted. But there’s no legal protection if your account gets frozen or a dispute goes against you.

Why can’t I use Binance or OKX for RUB trades anymore?

Binance and OKX stopped offering Russian ruble (RUB) trading entirely in 2024 due to international sanctions and pressure from Russian banking regulators. Even though their apps still work, you can’t deposit or withdraw RUB. They either withdrew their RUB payment processors or were forced to shut them down. As of 2025, these platforms show zero RUB trading volume in Russia.

What’s the safest P2P platform for Russian users in 2025?

Bybit is currently the safest and most reliable option. It has the highest trading volume, full Russian-language support, strict user verification, and a strong dispute resolution system. It also supports the widest range of local payment methods, including SBP, Sberbank, Tinkoff, and MIR cards. Its reputation system filters out low-quality traders, reducing scam risk.

Can my bank account be frozen for using P2P crypto?

Yes, and it happens often. Russian banks use automated systems to flag transactions linked to crypto exchanges-even if you’re just buying USDT with a debit card. Sberbank and Tinkoff are the most aggressive. If your account gets frozen, you may need to prove the source of funds. Many users report freezes lasting 30 days or more, with no clear way to appeal. Using a separate bank account just for crypto reduces this risk.

Are there any alternatives to P2P trading in Russia?

There are no legal, bank-backed alternatives. Some users turn to OTC (over-the-counter) brokers, but these are often unregulated and carry higher scam risk. Others use crypto ATMs, but they’re rare and have high fees. A few use foreign exchanges with VPNs, but that’s against Russian law and can lead to account bans. For now, P2P is the only practical option for converting crypto to rubles.

Just tried Bybit P2P last week-total game changer. Sent RUB via Tinkoff, got USDT in 90 seconds. No drama, no questions asked. My bank didn’t even blink. If you’re still stuck on Binance, you’re living in 2022.

Also, SBP is magic. Instant. Unstoppable. Use it.

It’s wild how Russia turned financial sanctions into a crypto revolution. No central bank? No problem. People just built their own system-like digital barter with escrow bots and color-coded bank icons. It’s anarchic, beautiful, and terrifying all at once.

Imagine if the West had done this instead of banning crypto. We’d be riding DeFi wave trains right now.

This is all just illegal money laundering dressed up as innovation. Russia’s economy is crumbling and people are using crypto to dodge sanctions. Don’t romanticize it. It’s criminal.

Boring. Just use USDT and move on.

The notion that peer-to-peer trading constitutes a legitimate financial infrastructure is deeply misguided. This is informal, unregulated, and inherently unstable. No reputable economist would endorse such a system as anything more than a stopgap for financial illiterates.

Let’s be real-most people don’t understand the real mechanics here. You think buying USDT via SBP is safe? Nah. You’re just trading trust with strangers who’ve spent months gaming the reputation system. The 98% completion rate? That’s often bought with micro-trades. Real pros use limit orders on the spot market first, then P2P only for bulk cash-out.

And don’t get me started on the price slippage. I lost 4.7% on a $5k trade last month because I trusted the listed rate. The platform doesn’t lock prices-it just shows you what someone *wants* to pay. You’re the liquidity provider. You’re the risk.

Also, MEXC’s Traderfest? Total bait. You get free trades on 3 coins out of 2800. The rest? Taker fees still eat you alive. And HTX? Their support replies in Google Translate Russian. I once waited 14 hours for a dispute resolution. My USDT was locked the whole time.

Bitget’s 125x leverage? That’s not a feature, it’s a suicide pact. People blow up accounts daily. And using BGB for discounts? That’s like paying with lottery tickets. Volatility on the discount token can wipe your savings faster than the ruble in 2022.

And yes, your bank *will* freeze you. Even if you’re using a separate account. Banks use AI now. They flag anything that looks like ‘crypto behavior’-even if it’s just transferring to a wallet that once held USDT.

Oh, and the ‘official app’ advice? Scammers clone the apps. I saw a fake Bybit login page on VK that had SSL, a .ru domain, and even a ‘verified’ badge. Took me 20 minutes to spot the font was 0.5px off.

Bottom line: P2P isn’t a system. It’s a survival mode. And if you think you’re ‘playing smart,’ you’re just delaying the inevitable.

Big shoutout to the folks actually keeping this alive. I’ve been using Bybit for 18 months now-no freezes, no issues. Just follow the rules: 2FA, SBP only, 100+ trades, screenshot everything.

Also, try MEXC’s wallet feature. You can buy RUB directly with a debit card inside the app. No P2P needed. It’s like a mini-bank built into crypto. Less friction, less risk.

And yes, the legal gray zone is real. But so is the fact that 2 million Russians are using this to pay rent, buy medicine, and send money home. This isn’t crime. It’s community resilience.

Don’t let the suits tell you it’s ‘illegal.’ It’s just unregulated. Big difference.

So we’re celebrating financial chaos now? Brilliant. Just let the unregulated wild west thrive while proper institutions get crushed by regulation. Truly progressive.

Also, why are we even discussing this? It’s not a model. It’s a symptom.