There’s no such thing as a Sphynx Labs crypto exchange - at least not in the way you might expect. You won’t find a sleek, regulated platform like Binance or Coinbase where you deposit USD, buy Bitcoin with a click, and withdraw to your bank. Instead, Sphynx Labs is a mobile-first DeFi ecosystem built around its own token, SPHYNX. It’s not an exchange. It’s an all-in-one wallet, swap tool, staking portal, and NFT marketplace rolled into one app. And that distinction matters - a lot.

What Sphynx Labs Actually Is

Sphynx Labs isn’t a traditional exchange. It’s a decentralized finance (DeFi) platform built on mobile. The core product is the Sphynx DeFi App, available on Google Play. It’s been downloaded by thousands and holds a 4.9-star rating from over 1,300 reviews. That sounds impressive - until you dig into what those reviews really say.The app lets you:

- Store multiple cryptocurrencies in a Web3 wallet

- Swap tokens directly inside the app

- Stake SPHYNX to earn rewards

- Participate in yield farming

- Trade NFTs

- Use a cross-chain bridge to move assets between blockchains

- Access a launchpad for new crypto projects

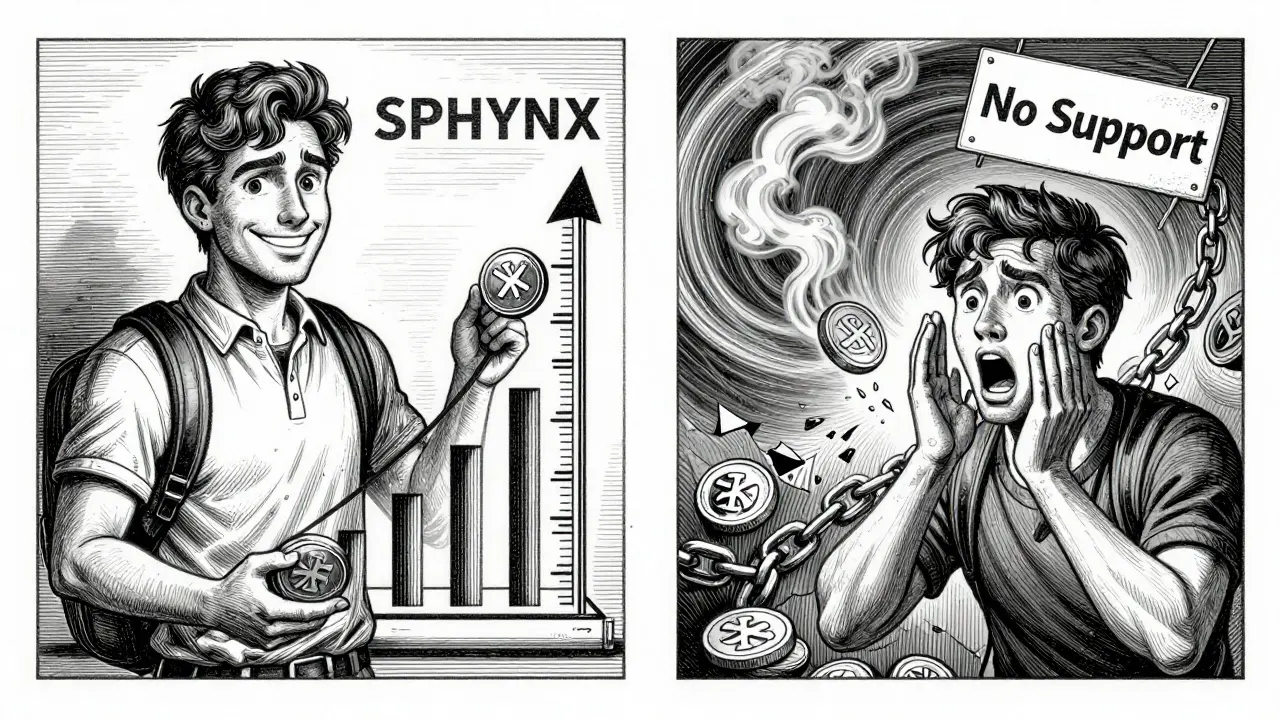

That’s a lot. And for users tired of juggling 5 different apps, it’s tempting. But here’s the catch: you’re not trading on Sphynx Labs’ own exchange. You’re using their app to interact with decentralized protocols. That means you’re responsible for every transaction - no customer support hotline, no chargebacks, no refunds if something goes wrong.

The SPHYNX Token: Supply, Price, and Volatility

The entire ecosystem runs on SPHYNX, the native token. Total supply? 1.5 billion. That’s fixed. No more will ever be created. As of late September 2025, the market cap sat at just $1.13 million. That’s tiny. For comparison, Bitcoin’s market cap is over $1 trillion. SPHYNX is a micro-cap token - the kind that can swing 20% in a single day.Price data is all over the place. CoinCodex says $0.000723. Bybit says $0.00089. 3Commas shows $0.000829. Why the difference? Because SPHYNX trades on multiple decentralized exchanges (DEXs), not one central hub. Each platform has its own liquidity pool, and with low volume, prices drift.

It hit an all-time high of $0.0095 in April 2024. That’s over 1,000% above where it stands now. It hit a low of $0.000645 in September 2025. That’s a 30% drop in just a few weeks. This isn’t just volatility - it’s extreme. And with a 24-hour trading volume of only $414, you’re dealing with a token that can be easily manipulated. A single large trade could crash the price.

Where You Can Actually Buy SPHYNX

You won’t find SPHYNX on Coinbase, Kraken, or Gemini. It’s not listed on any major centralized exchange. Your options are limited:- Bybit: You can trade SPHYNX here, but you need to complete KYC Level 1. You deposit USDT or BTC, then place a market or limit order.

- LetsExchange.io: A DEX aggregator that lists over 5,700 tokens. It’s not regulated, and you’re trading peer-to-peer.

- Decentralized exchanges: Like PancakeSwap or Uniswap, if SPHYNX is listed on them. You’ll need a wallet like MetaMask and some ETH or BNB for gas fees.

There’s no official Sphynx Labs exchange. The app doesn’t let you buy SPHYNX with a credit card. You have to bring your own crypto in from elsewhere. That’s a barrier for beginners.

User Reviews: Love It or Call It a Scam?

This is where things get messy. The Google Play Store reviews are glowing - 4.9 stars. But read the details.Positive reviews say: "This is the only app I need for DeFi." "The UI is beautiful." "Staking rewards are great." Negative reviews say: "I sent tokens in and never got them back." "I shouldn’t have to pay to swap my coins." "This is a scam." What’s happening? Two possibilities:

- Users don’t understand DeFi fees and slippage. Swapping tokens on DEXs costs gas, and if you set your slippage too low, the trade fails - and your tokens stay locked until you cancel it.

- The app has bugs or poor liquidity, causing failed transactions that look like theft.

Either way, the lack of customer support is a red flag. If your tokens disappear, there’s no email, no chat, no ticket system. You’re on your own. That’s normal in DeFi - but it’s still risky when the platform markets itself as "easy" and "user-friendly."

Technical Outlook: Bearish and Low Liquidity

The numbers don’t lie. Technical indicators for SPHYNX are all pointing down:- Price is below both the 50-day and 200-day moving averages - classic bearish signal.

- RSI at 48.5? Neutral. But with low volume, that means nothing.

- Only 43% of trading days in the last 30 were green.

- Forecasters predict a drop to $0.0005 by late 2025 - a 25% decline.

- WalletInvestor expects it to stay under $0.00055 through 2029.

Low liquidity + bearish trends + micro-cap status = high risk. You’re not investing in a company. You’re betting on a token with no revenue, no profit, and no clear path to adoption beyond its own app.

Security and Privacy: No Data Collected - But That’s Not a Win

The Sphynx DeFi App claims it doesn’t collect any user data. That sounds great - until you realize: in DeFi, no data collection means no accountability. If you lose your private key, there’s no recovery. If you get hacked, there’s no insurance. If you’re scammed, there’s no help line.That’s not privacy. That’s abandonment.

Most centralized exchanges have fraud protection. Sphynx Labs doesn’t. The app’s privacy policy isn’t a feature - it’s a warning.

Who Should Use Sphynx Labs?

Let’s be clear: this isn’t for beginners. It’s not for people who want to buy Bitcoin and hold it. It’s not for anyone who expects customer support.This is for:

- Experienced DeFi users who already understand gas fees, slippage, and wallet security

- People who want to try multiple DeFi tools in one place - and are okay with the risk

- Those who believe in the long-term vision of the SPHYNX ecosystem

It’s NOT for:

- New crypto investors

- People who want to trade with fiat (USD, EUR)

- Anyone who trusts apps with 4.9-star ratings without reading the bad reviews

If you’re tempted by the all-in-one design, ask yourself: do I really need one app to do everything? Or am I just making it easier for a small team to take my money?

The Bottom Line

Sphynx Labs isn’t a crypto exchange. It’s a risky DeFi experiment wrapped in a polished app. The SPHYNX token is volatile, illiquid, and trading at a fraction of its peak. The user reviews are split between genuine praise and serious accusations of lost funds. The technical outlook is bearish. And there’s zero safety net if things go wrong.There’s potential here - the feature list is ambitious. But potential doesn’t pay your bills. If you’re going to use it, treat it like a gamble. Only invest what you can afford to lose. And never, ever trust a 4.9-star rating without reading the one-star reviews.

There are safer, more liquid ways to access DeFi. Sphynx Labs might be a fun experiment - but it’s not a reliable investment.

Is Sphynx Labs a real crypto exchange?

No, Sphynx Labs is not a traditional crypto exchange. It’s a mobile DeFi app that lets you swap tokens, stake, farm yields, and trade NFTs - but you can’t buy SPHYNX directly with USD or other fiat currencies through it. You need to bring your own crypto from another platform like Bybit or LetsExchange.io.

Can I trust the Sphynx DeFi App?

The app has a 4.9-star rating, but many users report lost funds after swapping tokens. There’s no customer support, no chargebacks, and no way to recover assets if a transaction fails. High ratings don’t equal safety in DeFi. Treat it like a high-risk experiment, not a secure platform.

Where can I buy SPHYNX tokens?

SPHYNX trades on decentralized platforms like Bybit and LetsExchange.io. You’ll need to complete basic KYC on Bybit and deposit crypto (like USDT or BTC) to trade. It’s not available on Coinbase, Kraken, or any major centralized exchange.

Is SPHYNX a good investment in 2026?

Most forecasts are bearish. Analysts predict SPHYNX could drop below $0.0005 by the end of 2025 and stay there through 2029. With a market cap under $1.2 million and daily trading volume under $500, it’s extremely volatile and illiquid. Only experienced DeFi users with high risk tolerance should consider it.

Why do some users say Sphynx Labs is a scam?

Users report sending tokens into the app for swaps and never receiving them back. This can happen due to high slippage, failed transactions, or poor liquidity - not necessarily fraud. But without customer support or transaction recovery, it feels like a scam. Always double-check gas fees and slippage settings before confirming any trade.

Does Sphynx Labs have a wallet?

Yes. The Sphynx DeFi App includes a built-in Web3 wallet that supports multiple blockchains. But it’s non-custodial - meaning you control the private keys. If you lose access to your device or forget your backup phrase, your funds are gone forever. There’s no password reset or recovery option.

What’s the total supply of SPHYNX tokens?

The total and maximum supply of SPHYNX is capped at 1.5 billion tokens. No more will ever be created. As of late 2025, the circulating supply was close to full, with a market cap of around $1.13 million.

Can I stake SPHYNX in the app?

Yes. The Sphynx DeFi App offers staking for SPHYNX tokens, allowing users to earn rewards. But staking rewards in micro-cap tokens are often inflated to attract users. The actual value of those rewards may be minimal if the token price drops - which is likely, given current trends.

This isn't just risky-it's a honeypot. I've seen this script before. The 4.9-star rating? Bot reviews. The app's on Google Play but has zero verifiable team members. That 'SPHYNX token'? A rug pull waiting to happen. I checked the contract address-no audit, no liquidity lock, devs can mint more if they want. They're not even hiding it. They're *bragging* about the low liquidity so they can pump and dump. And don't get me started on the 'cross-chain bridge'-that's just a fancy way to say 'send your ETH here and pray.' I lost $8K on something just like this in 2021. This is worse. At least back then they had a whitepaper. This? Just a screenshot and a dream.

They're not building a platform. They're building a exit scam with a UI.

Don't touch it. Run.

Oh sweet mercy. Another crypto bro mistaking a glorified wallet for an 'exchange.' You don't need to be a genius to figure this out. The app doesn't *hold* your money-it just lets you poke at DeFi protocols while pretending it's a bank. And the SPHYNX token? A 1.5B supply with a $1M market cap? That's not a coin, it's a lottery ticket written in JavaScript.

Let me break it down for the folks still scrolling past the red flags: if your 'investment' has a 24-hour volume lower than your monthly Starbucks habit, you're not investing-you're feeding a gambling addiction wrapped in a mobile app.

And yes, the 4.9-star ratings? Mostly from people who don't know what slippage is. Read the one-star reviews. The ones saying 'I sent 500 USDT and it vanished'? That's not a bug. That's the business model.

Use MetaMask. Use Uniswap. Don't let some anonymous dev in a Discord server convince you that one app can do it all. You're not saving time-you're signing up for a nightmare.

imagine trusting an app with no customer service and no backing just because it has a pretty interface. this is how people get robbed. the devs are prob in a basement in russia or something. they dont care if you lose your money. they just want you to buy the token so they can cash out. why would any legit company make a token with zero liquidity? its a trap. the government should shut this down. i saw a video where someone lost 20k and the devs just disappeared. this is not crypto. this is fraud.

okay i tried this app last month and honestly? the ui is kinda slick. i was skeptical but the staking rewards were legit for a week. then my swap failed and i lost like $30 in gas fees and the tokens just… stayed stuck. no error message, no help button, nothing. i reached out on twitter and got a bot reply. so yeah, it’s pretty but it’s also a black hole for your crypto.

also-why does the website look like it was made in 2017 but the app is all neon and gradients? mismatched vibes. i think they hired a designer who just wanted to make something cool and a dev who barely knows solidity. not a combo i wanna risk my life savings on.

still, i’m kinda tempted to buy more SPHYNX because the price is so low. like… what if it goes up 1000x? but then i remember the 24-hour volume is less than my pizza delivery. yeah. no.

you people are being so dramatic. i used this app for 3 weeks and my staking rewards were steady. yes the price dipped but so what? crypto is volatile. if you can’t handle that then don’t touch anything. also the reviews are real-i know people who made 3x on SPHYNX. you just hate it because you didn’t get in early. stop FUDding. it’s not a scam, it’s just not for weak hands.

the real question isn't whether this is a scam or not it's whether we're okay with building systems that assume users are rational actors when they're not

the app doesn't need to be evil to destroy people it just needs to be indifferent

you don't need malice to cause harm you just need bad design and zero accountability

and that's what this is

the fact that people call it 'user friendly' while offering no safety net is the most dangerous part

we treat crypto like it's a game when it's really a minefield with no maps

and we keep giving out medals to the people who run through it blindfolded

bro this is just like doge but with more vibes 🚀💸

why you all scared? if you not holding SPHYNX you not living 🤡

the moon is coming and you sleeping 😴

100x or bust 💯

gm everyone 🌕✨

just stake and HODL 🤝

For what it's worth, I spent a week testing this app with a small amount-$100 max. The interface is clean, the staking dashboard works, and the token swap feature is surprisingly fast. But here's the thing: I didn't lose anything because I didn't expect to get anything back. I treated it like a sandbox, not an investment. If you're going to use this, do the same. Use play money. Learn how slippage works. Watch how gas fees eat into your trades. Understand that if you mess up, there's no one to call. That’s the real lesson here-not whether SPHYNX will go up, but whether you're ready to be your own bank. Most people aren't. And that's okay. Just don't pretend you are.

Also-read the contract. No mint function. No pause function. That's actually kind of refreshing. It's not a scam. It's just… unkind to beginners.