Optimistic Rollups: What They Are and Why They Matter in Crypto

When you hear optimistic rollups, a Layer 2 scaling solution for Ethereum that bundles hundreds of transactions into a single proof before posting to the main chain. Also known as ORUs, they’re one of the most practical ways to make crypto faster and cheaper without giving up security. Unlike other scaling methods that require complex math to verify every transaction, optimistic rollups assume everything is valid by default—and only check if someone calls them out. It’s like trusting your neighbor to park correctly, unless you see them smashing into your car.

This approach cuts Ethereum’s transaction costs by up to 90% and lets apps handle thousands of trades per second. That’s why projects like Arbitrum, a leading optimistic rollup network powering DeFi and NFT platforms and Optimism, the original optimistic rollup built to make Ethereum scalable for everyday users are behind so many popular dApps. They don’t need to reinvent the wheel—they just stack more transactions on top of Ethereum’s security. That’s the whole point: keep the safety of Bitcoin-level decentralization but with the speed of a payment app.

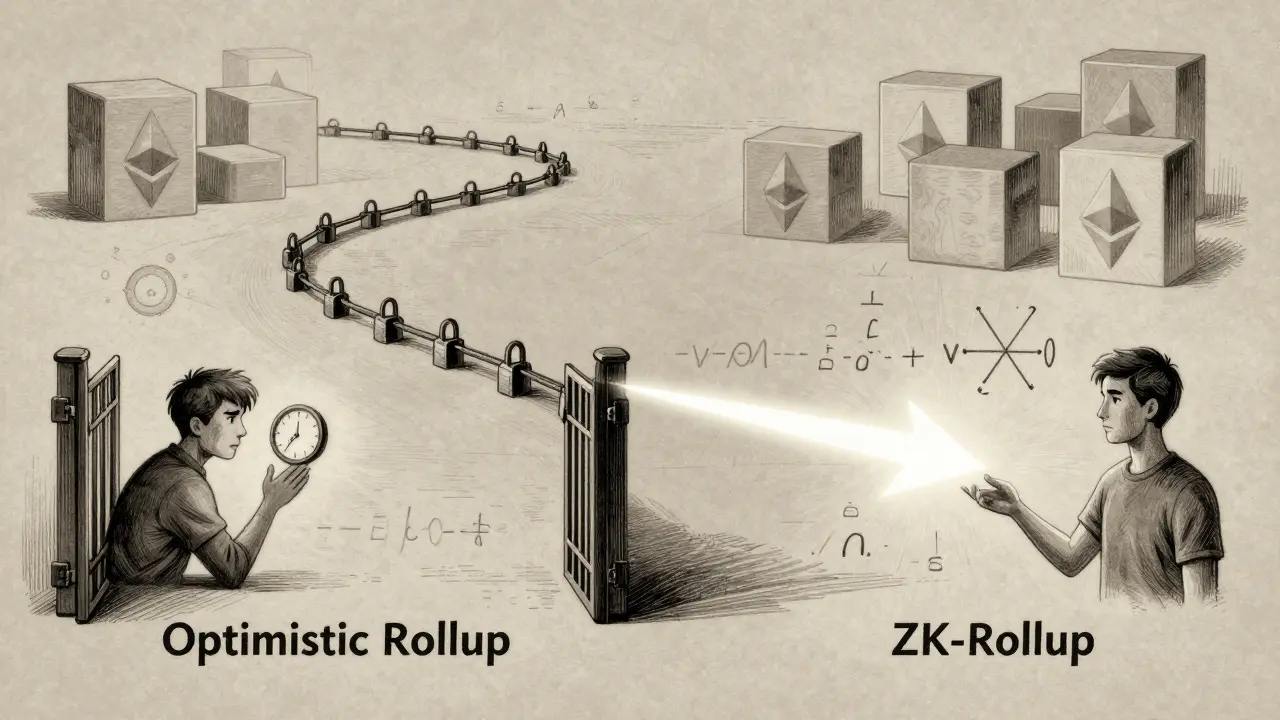

But optimistic rollups aren’t perfect. They have a 7-day challenge window where anyone can dispute a transaction. That’s fine for large exchanges or DeFi protocols, but a pain if you’re trying to cash out fast. That’s where zk-rollups, a competing Layer 2 tech that uses cryptographic proofs instead of assumptions come in—they’re faster to finalize but harder to build. Most new projects still pick optimistic rollups because they’re easier to code for and support smart contracts without rewriting them.

What you’ll find in this collection isn’t theory. It’s real-world examples of how these technologies affect you. You’ll see how fake airdrops ride the hype of new rollup chains, how exchanges pretend to be "ZK-powered" when they’re just custodial wallets, and why some tokens labeled as "Ethereum rollup" coins are barely connected to the tech at all. We’ve dug into platforms like Omni Network, ZKE, and others to separate what’s built on real rollup infrastructure from what’s just marketing buzz. If you’re trying to figure out which projects actually use optimistic rollups to deliver value—or which ones are just slapping the term on their website—this is your guide.

Transaction Finality in Rollups: How Optimistic and ZK-Rollups Differ in Speed and Security

Transaction finality in rollups varies drastically between optimistic and ZK-rollups. Optimistic rollups require up to 7 days for full security, while ZK-rollups achieve finality in minutes through cryptographic proofs. Understanding these differences is critical for developers and users alike.