Rollup Finality Calculator

Calculate the correct finality stage for your transaction based on use case and value

When you send a transaction on Ethereum, you expect it to be final-gone forever, unchangeable, secure. But on Layer 2 rollups, that’s not always true. Not right away. And the difference between transaction finality in optimistic rollups versus ZK-rollups isn’t just technical-it affects how much money you can lose, how fast your DeFi trades execute, and whether your bridge withdrawals get stuck for days.

What Does Finality Even Mean?

Finality is the moment a transaction becomes irreversible. On Ethereum mainnet, that happens after about 12.8 minutes. That’s when the block containing your transaction gets two full epochs of consensus votes under proof-of-stake. No reorgs. No reversals. Just done. Rollups don’t do this themselves. They piggyback on Ethereum. But they add layers. And those layers change the game. A transaction can be included in a rollup block within seconds. But that doesn’t mean it’s final. Not even close.Optimistic Rollups: Trust, But Verify (After 7 Days)

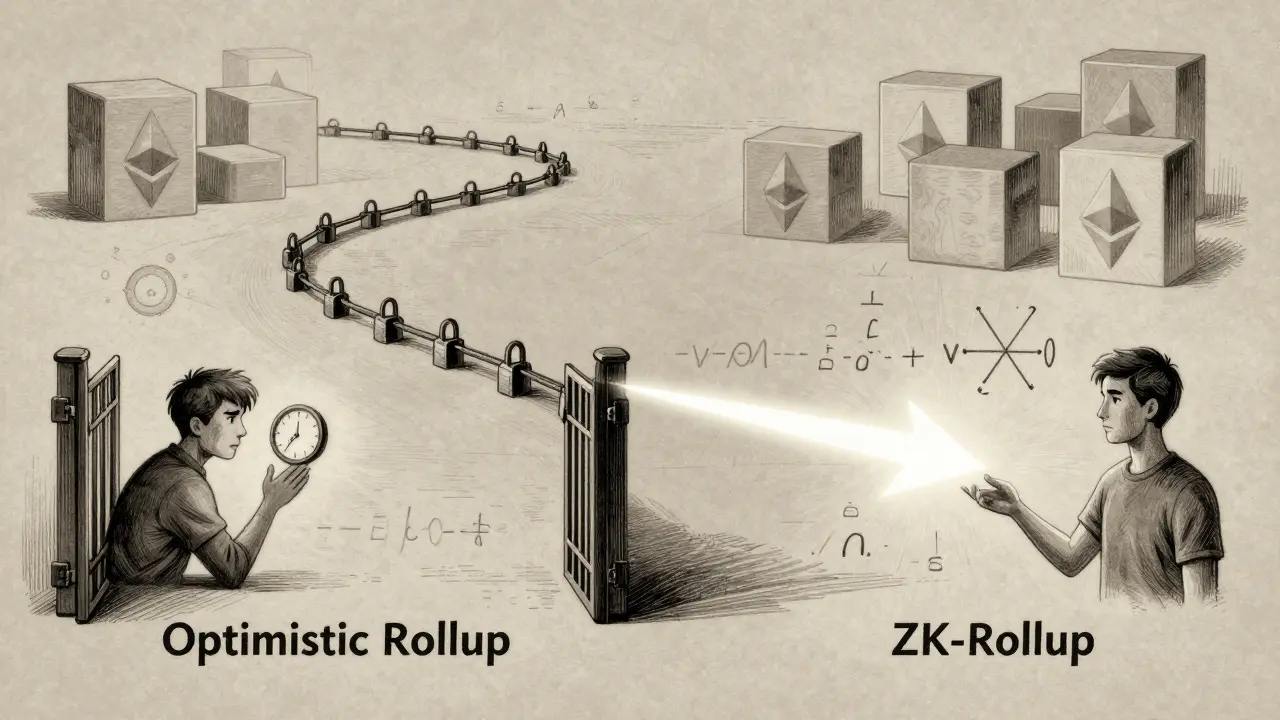

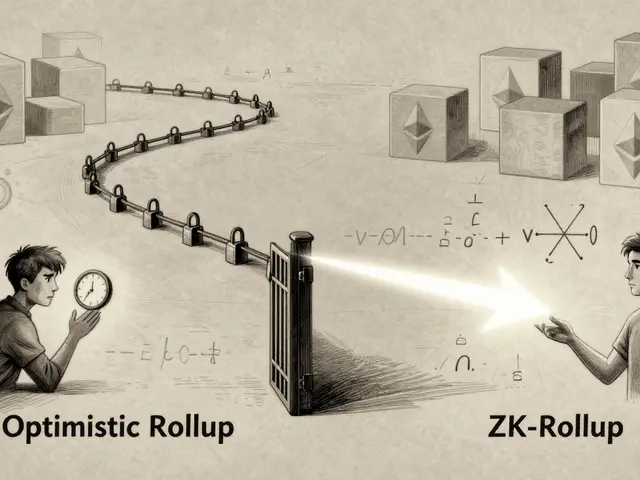

Optimistic rollups like Optimism and Arbitrum assume transactions are valid unless someone proves otherwise. That’s why they’re called “optimistic.” They don’t verify every transaction on Ethereum. Instead, they post transaction data to Ethereum and wait. Here’s the catch: they leave a 7-day window open for anyone to challenge a transaction with a fraud proof. If someone spots a bad transaction-say, someone minting fake tokens-they can submit a cryptographic proof to Ethereum and get the whole block reverted. That 7-day period isn’t just a suggestion. It’s the core of security. But it’s also the biggest UX headache. Developers report users losing arbitrage opportunities because withdrawals take too long. Exchanges like Binance require 150 Ethereum confirmations (about 37.5 minutes) before allowing Optimism withdrawals. Coinbase waits 4 hours. That’s not because the transaction is unsafe-it’s because they’re playing it safe. But here’s what most people don’t realize: you don’t have to wait 7 days for most use cases. Optimism breaks finality into three stages:- Unsafe: The sequencer included your tx. Seconds after submission. No Ethereum confirmation yet.

- Safe: Your transaction data is on Ethereum. Usually 5-10 minutes after submission. This is enough for most apps.

- Finalized: The Ethereum block containing your data is fully confirmed. About 12.8 minutes after submission. This is the real finality.

ZK-Rollups: Prove It, Then It’s Done

ZK-rollups like zkSync, StarkNet, and Polygon zkEVM work differently. They don’t wait for challenges. They prove everything upfront. Every batch of transactions comes with a zero-knowledge proof-a mathematical guarantee that all transactions in the batch are valid. No fraud possible. No dispute window. No waiting. That proof gets posted to Ethereum. Once Ethereum accepts it, the transactions are final. No ifs, ands, or 7-day waits. This means finality happens in minutes. StarkNet claims 10 minutes. zkSync Era? 5-15 minutes, depending on Ethereum congestion. That’s faster than Ethereum mainnet finality for many users. And it’s not just speed. It’s security. ZK-rollups don’t rely on the assumption that someone will monitor for fraud. They rely on math. That’s why DeFi protocols like dYdX and Curve moved to zkSync and StarkNet. They need certainty. Fast.

Why This Matters for Developers

If you’re building a dApp on a rollup, you can’t treat it like Ethereum. You can’t just wait for a few blocks. You have to know which finality state you’re checking. Trail of Bits found that 38% of apps made the same mistake: they assumed “safe” meant “final.” That’s dangerous. If a reorg happens on Ethereum (rare, but possible), a transaction marked “safe” could be rolled back-even if it’s been on-chain for 10 minutes. Proper implementation means:- Using the Optimism SDK’s

isFinalized()method, not block height counters. - Listening for Ethereum’s

forkchoiceUpdatedevent, not just polling block numbers. - For ZK-rollups, waiting for the proof to be verified on Ethereum, not just the batch being posted.

Market Trends: Who’s Winning?

In Q2 2023, rollups handled 68% of all Ethereum transactions. Optimistic rollups still lead in market share (52%), mostly because they’re cheaper and easier to build on. NFTs, games, and social apps thrive there. But ZK-rollups are catching up fast. DeFi apps on ZK-rollups grew 227% in the same quarter. Why? Finality speed. Users don’t want to wait days for their stablecoin swap to settle. Regulators are noticing too. The European Securities and Markets Authority says the 7-day challenge period conflicts with MiCA’s requirement for settlement finality within 24 hours. Exchanges are responding. Binance lets you withdraw from zkSync instantly. For Optimism? You wait. Coinbase does the same. The market is voting with its wallets.

Man, I’ve been on Optimism for months and I still get startled when my withdrawal says ‘pending’ for 7 days. I thought it was a glitch at first. Then I read the docs and realized - oh right, this is how it’s supposed to work. It’s wild that we’ve normalized waiting a week for something that’s technically already on-chain. I get why devs do it - fraud proofs are genius - but UX-wise? It’s like ordering pizza and getting a 7-day countdown before the box opens. I’ve switched half my DeFi stuff to zkSync now. No drama. No stress. Just boom, done. And my portfolio thanks me every time I swap USDC.

Also, shoutout to zkSync’s docs. They actually explain what ‘proof verified’ means without sounding like a PhD thesis. That alone made me switch. Why can’t everyone be this clear?

And yeah, I know ZKs are pricier to deploy, but if you’re moving real money, isn’t speed and certainty worth the gas? I’d rather pay 0.02 ETH extra and sleep at night than save 0.005 and lose sleep over a reorg.

Also, the 37% bridge failure stat? That’s not a prediction. That’s a warning label. We’re all just one bad contract away from a $200M disaster. Let’s not pretend we’re not all gambling with our wallets.

And don’t even get me started on how some exchanges still treat ‘safe’ as final. Binance’s 150 confirmations? That’s not security. That’s fear. And fear doesn’t scale.

TL;DR: ZKs win on finality. Optimism wins on ease. Pick your poison. But stop pretending they’re the same thing.

People keep saying ZK-rollups are the future but nobody talks about how hard it is to build on them. The tooling is still in beta. The compilers crash. The debuggers are useless. I spent three weeks trying to port a simple ERC20 bridge and ended up rewriting half the contract because the zkSync compiler didn’t like my nested mappings.

Optimism? You write Solidity. You deploy. You’re done. Yeah, you wait 7 days. But at least you’re not debugging a proof system that doesn’t tell you why it failed.

I’m not anti-ZK. I’m pro-functional. If your app needs speed, go ZK. If you just want to let people mint NFTs of their cats? Stick with Optimism. Stop pretending this is a religion.

Okay but can we talk about how the word ‘finality’ is being weaponized here? It’s not a technical term - it’s a psychological one. People don’t care about ‘safe’ vs ‘finalized’ - they care about ‘when can I spend this?’

And the fact that exchanges are imposing their own waiting periods on top of the protocol’s? That’s not security. That’s liability management. And it’s making users distrust the whole system.

I used to think ZK-rollups were just fancy math. Now I see they’re the only layer-2 that actually respects user time. Not because they’re better code - but because they don’t make you wait for someone else to check your work.

Also, the MiCA angle? Huge. Europe’s about to force everyone to fix this. And when they do, Optimism’s 7-day window won’t be a feature - it’ll be a compliance nightmare.

LMFAO at all these ZK fanboys acting like they invented fire. ‘Prove it then it’s done’ - yeah, sure. But who’s proving it? A private company with a secret proving server? Cool. So now instead of trusting a decentralized network, I’m trusting a single entity that can lie and hide behind ‘zero-knowledge’ like it’s a magic shield.

And don’t even get me started on StarkNet. They’re basically a closed-source black box. The ‘proof’ is generated by their own servers. You can’t verify it yourself. So what’s the difference between this and a bank? Nothing. You’re just trusting a different middleman.

Optimistic rollups at least let anyone challenge. That’s real decentralization. ZK is just corporate crypto with a fancy name. And don’t tell me ‘math’ - math doesn’t stop fraud. People do. And ZK removes people from the loop.

Also, why is everyone ignoring that ZK proofs take 10x more compute? That’s why they’re expensive. That’s why they’re centralized. That’s why they’re not the future - they’re the corporate takeover.

😭😭😭

I think what’s missing here is the human side. We’re treating this like a math problem when it’s really a trust problem. People don’t want to understand ‘safe’ vs ‘finalized’ - they want to know if their money is safe. And honestly? Most users don’t care how it works. They just want it to work.

That’s why I think the real innovation isn’t in the tech - it’s in the UX. Like, what if your wallet just said ‘Your withdrawal is secure and will be available in 12 minutes’ instead of ‘Status: Safe (pending finalization)’? That’s the kind of design that bridges the gap between tech and people.

And ZKs? They’re not perfect, but they’re closer to what users actually need. Speed. Certainty. No waiting. No panic. No ‘is this a scam?’

But here’s the thing - we’re all so obsessed with which one is ‘better’ that we’re forgetting the goal: making crypto feel safe for normal people. Not just for devs who read whitepapers for fun.

Also, I really hope someone builds a ‘finality dashboard’ that shows you the real status of your tx across all chains. I’d pay for that. I’d buy a shirt with it.

So let me get this straight - you’re telling me we’ve spent 5 years building this whole ecosystem to replicate what banks did in 1995? And now we’re proud because we made it slower and more complicated?

Optimistic rollups: 7-day wait. ZK-rollups: 10-minute wait. Ethereum mainnet: 13-minute wait.

So… we’re not faster. We’re just… fancier?

And don’t even get me started on ‘safe’ finality. That’s not a status. That’s a trap. You’re telling me I can trust this tx but not really? Like a politician saying ‘I didn’t lie, I just omitted the truth.’

Also, 38% of devs get this wrong? That’s not a bug. That’s a systemic failure. We’re building a house on quicksand and calling it ‘innovation.’

And the worst part? We’re all acting like this is normal. It’s not. It’s a joke.

Also, why does every ZK project sound like a TED Talk? ‘Mathematical certainty!’ Bro. I just want to buy a coffee with crypto. Not solve P=NP.

Okay but can we just appreciate how wild it is that we’re having this conversation? Like, 15 years ago, people were arguing if Bitcoin could ever be used for pizza. Now we’re debating whether transaction finality should take 7 days or 5 minutes. And we’re doing it with emojis and memes and 10 different layers of abstraction.

It’s beautiful. And terrifying.

And honestly? I think ZKs are winning not because they’re better code - but because they feel more honest. You don’t have to ‘trust’ anyone. You just have to trust math. And math doesn’t lie. It just… doesn’t care.

Also, I love that zkSync lets me withdraw instantly. I used to check my balance 3x a day waiting for Optimism. Now I just do my trade and go make dinner. No stress. No panic. Just… done.

And yes, the dev experience is harder. But isn’t that the price of safety? We didn’t make planes safer by making them easier to build. We made them safer by making them harder to mess up.

Also, I’m putting a 🚀 on this comment. Because I believe in this. Not because I’m a fanboy. But because I’ve seen what happens when you give people certainty.

They stop being afraid.

7-day challenge window? More like 7-day scam window. Who even monitors these fraud proofs? I bet 99% of them are just bots run by the rollup team themselves. And ZKs? ‘Mathematical certainty’ my ass. You think the proving servers aren’t controlled by the same VC-funded startups that built the rollup? It’s all rigged.

And don’t tell me ‘decentralized’ - I’ve seen the node lists. 3 nodes. All owned by the same company. That’s not a network. That’s a front.

Also, why is no one talking about the fact that ZK proofs can be backdoored? The math is sound, but the code isn’t. And who audits the auditors?

And the ‘market is voting’? Yeah, with money they don’t fully understand. Most users think ‘instant withdrawal’ means ‘no risk.’ It doesn’t. It just means the risk is hidden.

They’re all scams. Just different flavors of the same Ponzi.

Also, why do I even bother? Nobody reads this anyway. 😔

ZK finality in 5 mins. Optimistic in 13. So ZK wins.