Rollups Explained: What They Are and Why They Matter in Crypto

When you hear rollups, a Layer 2 scaling solution that bundles hundreds of transactions into one on Ethereum to cut costs and speed things up. Also known as Layer 2 solutions, they’re the quiet engine behind today’s faster, cheaper crypto apps. Without them, Ethereum would be too slow and expensive for everyday use. Think of rollups like a bus that picks up dozens of passengers (transactions) and drives them to Ethereum’s main road in one trip—instead of letting each person drive their own car and clog the highway.

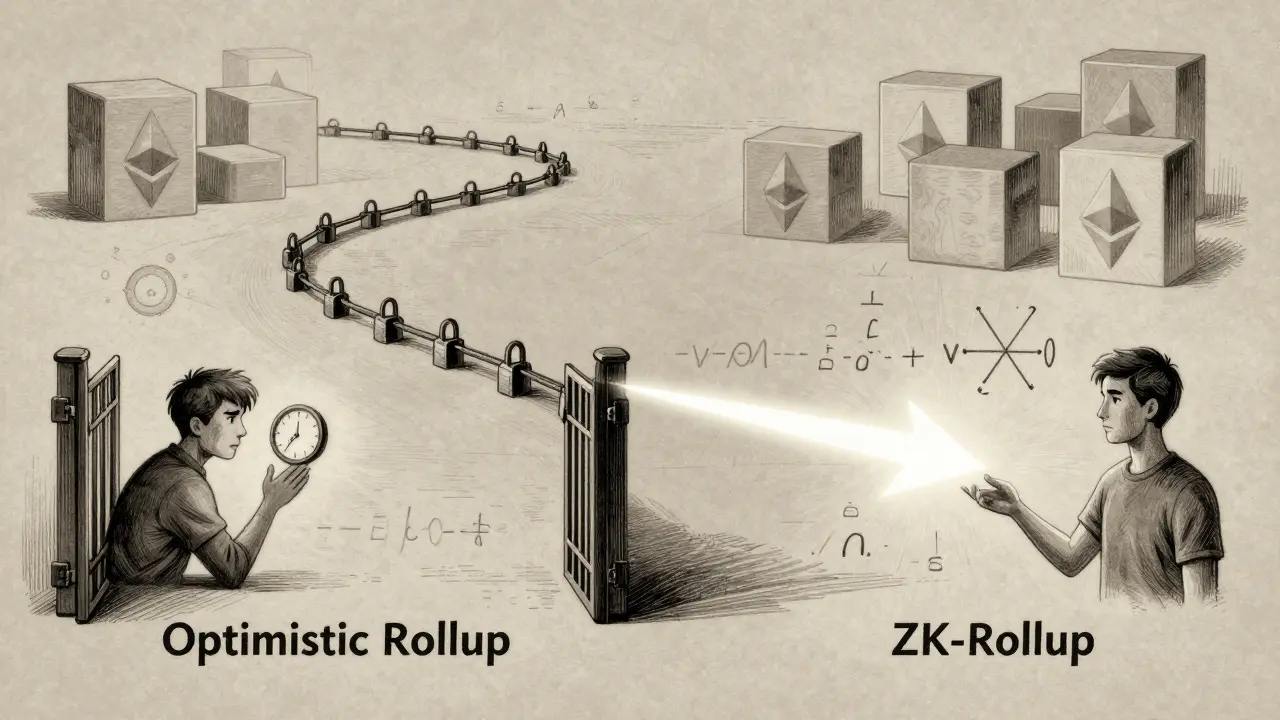

There are two main types: optimistic rollups, assume transactions are valid unless someone proves they’re not within a challenge period and zk-rollups, use cryptographic proofs to instantly verify every transaction’s accuracy. Optimistic rollups are simpler to build on but take longer to finalize—usually around a week. Zk-rollups are faster and more secure but need advanced math to work. Both reduce Ethereum fees by 90% or more. That’s why projects like Omni Network (OMNI) and ZKE Exchange use them—they need speed and low cost to compete.

Rollups aren’t just about saving money. They’re what let apps like DeFi platforms, NFT marketplaces, and even gaming tokens run smoothly. Without rollups, you’d pay $50 to trade a single NFT. With them, it’s under $1. That’s why so many crypto projects you see listed here—like the ones tied to Ethereum rollups in the Omni Network post—are built on top of them. They’re not optional anymore. They’re the foundation.

You’ll find posts here that dig into real examples: how Omni Network confused people because it shares a ticker with an old Bitcoin protocol, or how ZKE Exchange uses ZK tech but hides its ownership. These aren’t just technical deep dives—they’re warnings. Rollups sound simple, but the projects using them? Not always. Some are legit, some are smoke and mirrors. Knowing how rollups work helps you spot the difference.

What you’ll see below isn’t a list of buzzwords. It’s a collection of real cases where rollups matter—whether it’s the tech behind a token, the reason an exchange is fast or risky, or why a project’s claims don’t add up. You’ll learn what to look for, what to avoid, and how to tell if something’s built on solid ground—or just pretending to be.

Transaction Finality in Rollups: How Optimistic and ZK-Rollups Differ in Speed and Security

Transaction finality in rollups varies drastically between optimistic and ZK-rollups. Optimistic rollups require up to 7 days for full security, while ZK-rollups achieve finality in minutes through cryptographic proofs. Understanding these differences is critical for developers and users alike.