Transaction Finality in Crypto: What It Means and Why It Matters

When you send Bitcoin, Ethereum, or any crypto, you expect it to stick—no going back, no glitches. That’s where transaction finality, the point at which a blockchain transaction is permanently confirmed and cannot be reversed. Also known as blockchain finality, it’s the silent guarantee that your money landed where it was supposed to. Without it, crypto would be just digital noise. Imagine sending $5,000 to a friend, only to have it vanish 10 minutes later because someone rolled back the chain. That’s not speculation—it’s what happened on poorly designed networks. Transaction finality is what keeps users from losing trust, and it’s the reason some blockchains survive while others fade into obscurity.

Finality isn’t the same as confirmation. A transaction might show as "confirmed" after one block, but if the chain can still be reorganized—like in early proof-of-work systems—it’s not final. True finality means no amount of computing power or time can undo it. Networks like Bitcoin achieve this through deep block confirmations; Ethereum switched to proof-of-stake to make finality faster and mathematically guaranteed. Meanwhile, newer chains like Solana or Polygon use different methods—like probabilistic finality or checkpointing—to balance speed and security. But here’s the catch: if a chain doesn’t clearly define its finality mechanism, you’re gambling. That’s why so many posts in this collection warn about shady exchanges like ZKE or Amaterasu Finance—they hide behind tech buzzwords while offering zero real finality guarantees.

Finality also affects smart contracts. If a DeFi trade executes but the underlying transaction isn’t final, your liquidity pool could be drained before the system locks in the outcome. That’s why projects like Forward Protocol or TAOBOT, which rely on real-time interactions, need rock-solid finality to work at all. And when stablecoins like USDT depeg, it’s often because the underlying transactions weren’t final enough to prevent mass panic withdrawals. You can’t trust a token if the chain beneath it can be rewritten.

What you’ll find here isn’t theory. These posts show real cases where weak finality led to losses: BitForex users scrambling to withdraw before accounts vanished, Sparrow Exchange pretending to exist with no transaction history, and fake airdrops like TOWER or xSuter that vanish the moment you connect your wallet. Each one is a lesson in what happens when finality is ignored. Whether you’re claiming LOCG tokens, trading QI, or just holding Bitcoin, you need to know: is this chain final? Or is it just waiting for someone to hit undo?

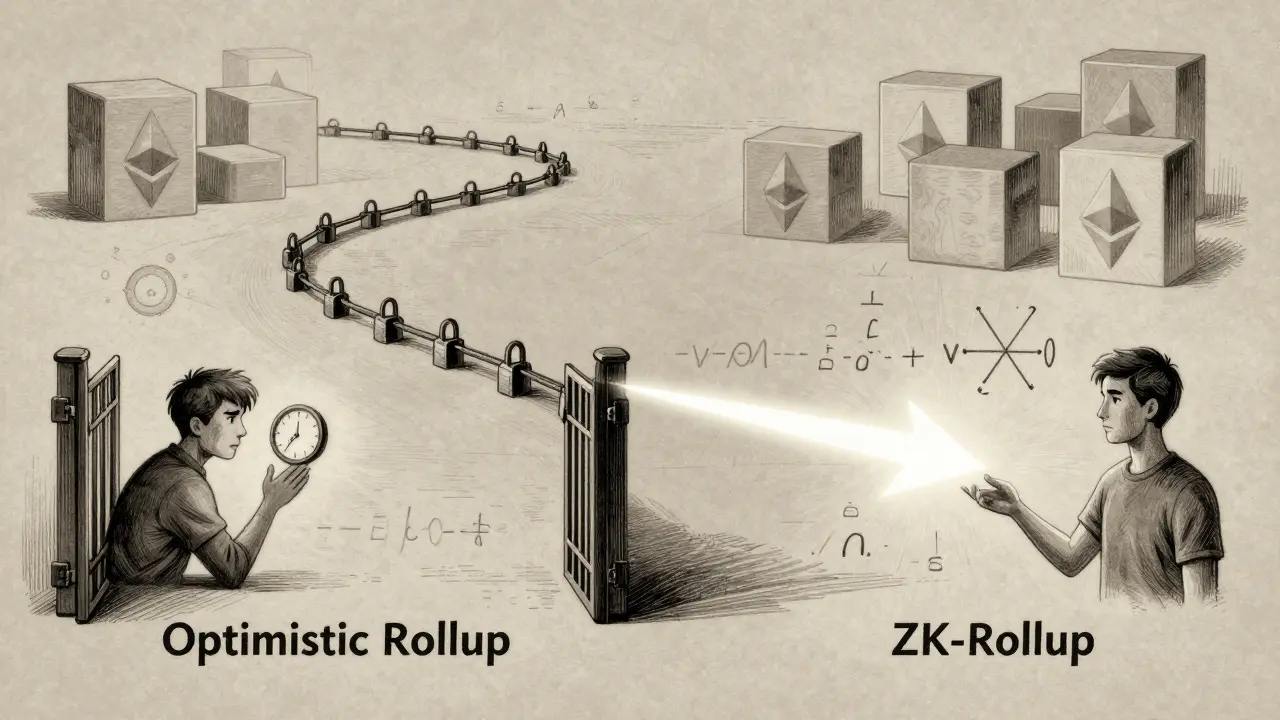

Transaction Finality in Rollups: How Optimistic and ZK-Rollups Differ in Speed and Security

Transaction finality in rollups varies drastically between optimistic and ZK-rollups. Optimistic rollups require up to 7 days for full security, while ZK-rollups achieve finality in minutes through cryptographic proofs. Understanding these differences is critical for developers and users alike.