Every time you hold a perpetual futures contract in crypto, you're paying or getting paid-whether you realize it or not. That’s the funding rate. It’s not a fee you choose to pay. It’s not a hidden charge. It’s a built-in mechanic that quietly reshapes your profits or losses every 8 hours. If you’ve ever watched your position go up in price but still lost money, funding rates are likely why.

What Exactly Is a Funding Rate?

Funding rates are periodic payments exchanged between long and short traders in perpetual futures contracts. They exist to keep the price of the perpetual contract close to the actual spot price of the underlying asset-like Bitcoin or Ethereum. Without funding rates, perpetual futures could drift wildly away from spot prices and become useless for hedging or accurate price discovery. This system was invented by BitMEX in August 2016. Before that, traders had to roll over traditional futures contracts every week or month, which was messy and expensive. Perpetual futures removed expiration dates, but created a new problem: how do you keep the price anchored? Funding rates were the answer. Here’s how it works in simple terms:- If the perpetual price is higher than the spot price, funding rates turn positive. Longs pay shorts.

- If the perpetual price is lower than the spot price, funding rates turn negative. Shorts pay longs.

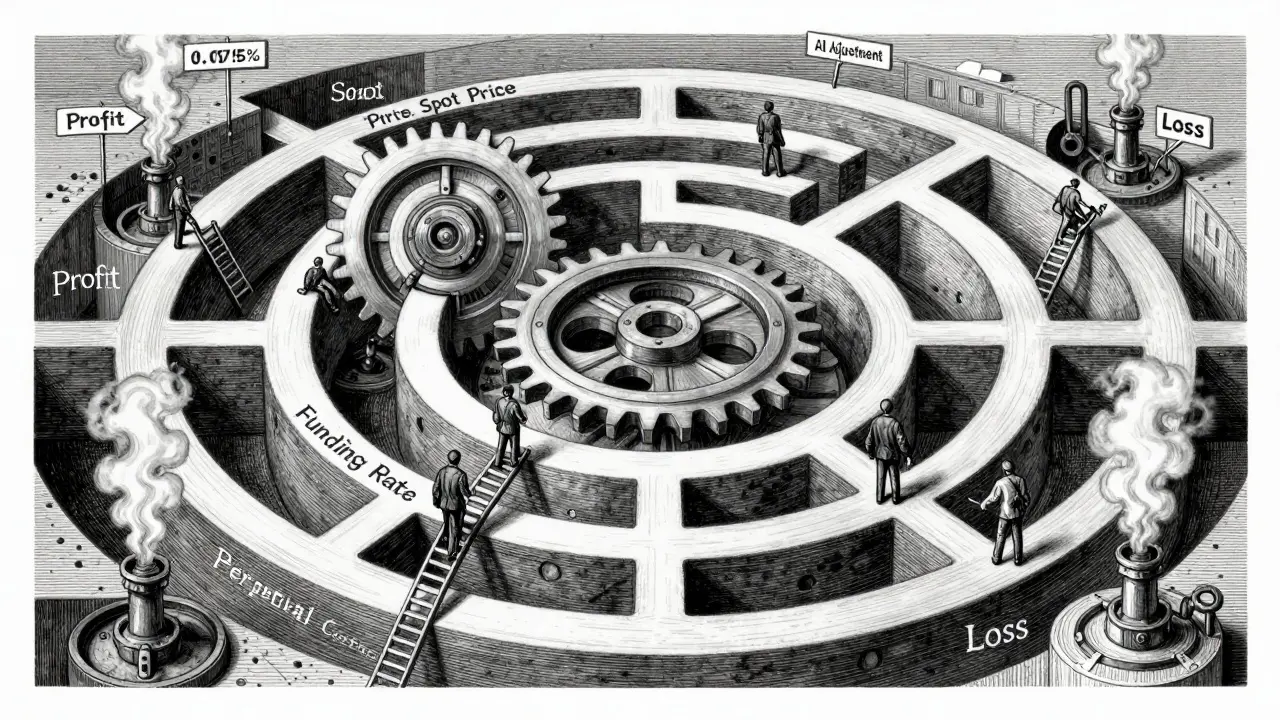

How Are Funding Rates Calculated?

Funding rates aren’t random. They’re calculated using two main parts: the premium index and the interest rate component. Most exchanges use a formula that looks at how far the perpetual price deviates from the spot price over time. For example, on June 15, 2024, BTC/USDT perpetual was trading at $67,180.50 while spot was at $67,250. That’s a $69.50 discount. The premium index reflected that, and the funding rate came out to -0.0156% per 8 hours. That means short holders paid long holders a small amount every 8 hours to balance the market. The calculation runs every minute, but payments happen every 8 hours-usually at 00:00, 08:00, and 16:00 UTC. This gives traders time to adjust without being hit with constant tiny payments. Some exchanges, like Bybit and Binance, also cap funding rates to prevent extreme swings. If the premium gets too high, the rate won’t go beyond a set limit-say, 0.075% per 8 hours. This helps avoid panic-driven liquidations.Why Funding Rates Can Kill Your Profits

You might think, “If the price goes up, I win.” But that’s not always true. In March 2021, during the biggest Bitcoin bull run, BTC funding rates spiked to 0.15% per 8 hours. That’s 16.4% annualized. If you held a long position for 30 days straight, you paid over 1.8% just in funding fees-even if Bitcoin rose 40%. Amberdata’s analysis shows that a sustained 0.1% per 8-hour funding rate equals about 1.095% per month in costs for longs. Over six months, that’s nearly 7% of your capital gone to funding payments. That’s not a small detail-it’s a profit killer. Reddit threads like “How funding rates destroyed my long position despite ETH going up 15%” aren’t rare. One trader lost 11% of their position value to funding payments while ETH rose 15%. Their net gain? Just 4%. That’s the hidden tax.

When Funding Rates Are Your Ally

Funding rates aren’t just a cost-they can be a source of income. Traders who understand the rhythm of the market use funding rates as a strategy. For example:- If funding rates are deeply negative-below -0.05% per 8 hours-it often means shorts are overextended. That’s a signal that the market may reverse. Smart traders go long here, collect payments from shorts, and ride the bounce.

- On the flip side, if funding rates are extremely positive, short sellers get paid to bet against the market. Many scalpers build positions on that.

How to Avoid Getting Screwed

Most retail traders lose money to funding rates because they don’t track them. Here’s how to protect yourself:- Check funding rates before entering any trade. Don’t just look at the chart. Open your exchange’s funding rate page. If it’s above 0.075% per 8 hours, think twice about going long.

- Use real-time trackers. Tools like CoinGlass aggregate funding rates across 25+ exchanges with minute-by-minute updates. You can set alerts for when rates cross your thresholds.

- Avoid holding longs during bull runs. When everyone’s excited, funding rates spike. If you’re not actively trading, consider closing positions before the weekend or major news events-funding rates often spike during low liquidity periods.

- Compare exchanges. Funding rates vary between platforms. One exchange might have +0.02%, another -0.01%. You can shift your position to the one that pays you.

What’s Changing in 2026?

The funding rate system isn’t static. Exchanges are making it smarter. In April 2024, dYdX launched adaptive funding rates that widen the neutral zone during high volatility. This cut unnecessary payments by 37%. Bybit introduced “Funding Rate Heatmaps” in May 2024-showing predicted rates 24 hours ahead with 78% accuracy. Amberdata’s “Smart Funding Rates” now use on-chain whale movements and options data to predict rates with 89% accuracy. Gartner predicts that by 2026, 70% of major exchanges will use AI to dynamically adjust funding intervals based on market conditions. Instead of every 8 hours, it might be every 4 hours during high volatility, or every 12 hours during calm periods. But there’s a dark side. Regulators are watching. The CFTC has sued BitMEX and Binance US over perpetual futures. The SEC’s proposed Digital Commodities framework could reclassify perpetual contracts as securities. If that happens, funding rates might need to be redesigned-or banned.Perpetual Futures vs. Traditional Futures

Traditional futures expire. You roll them over. You pay rollover fees. You deal with gaps in liquidity. Perpetual futures eliminate all that. You can hold forever. You trade 24/7. No expiration headaches. But perpetual futures have a cost: funding. Traditional futures don’t have this. If you’re holding a position for months in a low-volatility market, perpetuals can bleed you dry. Traditional futures win there. Perpetuals shine in high-volatility, fast-moving markets-exactly where crypto thrives. That’s why they make up 80-90% of all crypto derivatives volume today. Bitcoin perpetuals alone handle $55 billion daily. Ethereum adds another $20 billion.Final Takeaway: Funding Rates Are the Hidden Game

Funding rates aren’t a bug. They’re a feature. They’re the invisible hand that keeps perpetual futures from going off the rails. But they’re also the silent thief that can eat your profits if you’re not careful. If you’re trading crypto derivatives, you need to treat funding rates like you treat slippage or fees. Track them. Understand them. Use them. Don’t ignore them. The best traders don’t just bet on price. They bet on the structure of the market itself. And funding rates? They’re the most consistent, predictable, and repeatable edge in perpetual futures trading.What happens if I ignore funding rates?

Ignoring funding rates can lead to unexpected losses-even when your trade is winning. For example, if you hold a long position during a bull run with a 0.1% per 8-hour funding rate, you’ll pay over 1% per month just to keep the position open. Over time, that can erase 20% or more of your gains. You might think you’re profitable, but you’re actually losing money to payments you didn’t plan for.

Are funding rates the same on all exchanges?

No. Funding rates vary between exchanges because they use slightly different formulas, spot price sources, and risk controls. For example, Binance might have a funding rate of +0.01% while Bybit has -0.02% for the same asset. This difference is why arbitrage traders move positions across platforms to capture the spread. Always check rates on the exchange you’re using.

Can funding rates be manipulated?

Yes, and it’s happened. In November 2021, a whale moved $1.2 billion in BTC to briefly spike the funding rate to 0.25% per 8 hours, triggering mass liquidations of long positions. That’s called “funding rate manipulation.” Exchanges have since added circuit breakers and caps, but the risk still exists-especially in low-liquidity markets. Always watch for sudden, extreme spikes in funding rates.

How do I know if a funding rate is high or low?

A funding rate above 0.075% per 8 hours is considered high for longs and risky. Below -0.05% per 8 hours is considered a strong signal for longs (shorts are overextended). Neutral is around ±0.01%. Most retail traders should avoid long positions above 0.05% and short positions above 0.03% unless they’re actively trading the rate itself.

Do I get paid if I’m short and funding is negative?

Yes. If the funding rate is negative, short holders pay long holders. That means if you’re short, you’re paying out. But if you’re long and funding is negative, you’re getting paid. The direction of the payment depends on your position and the sign of the rate. Always double-check your exchange’s documentation-it’s easy to mix up who pays whom.

Is it possible to profit from funding rates without trading price?

Absolutely. Many professional traders make 3-8% monthly returns just by capturing funding differentials between exchanges. This is called funding rate arbitrage. You go long on an exchange with negative funding and short on one with positive funding. The price stays flat, but you collect payments from both sides. It’s low-risk, low-reward, and works best in sideways markets.