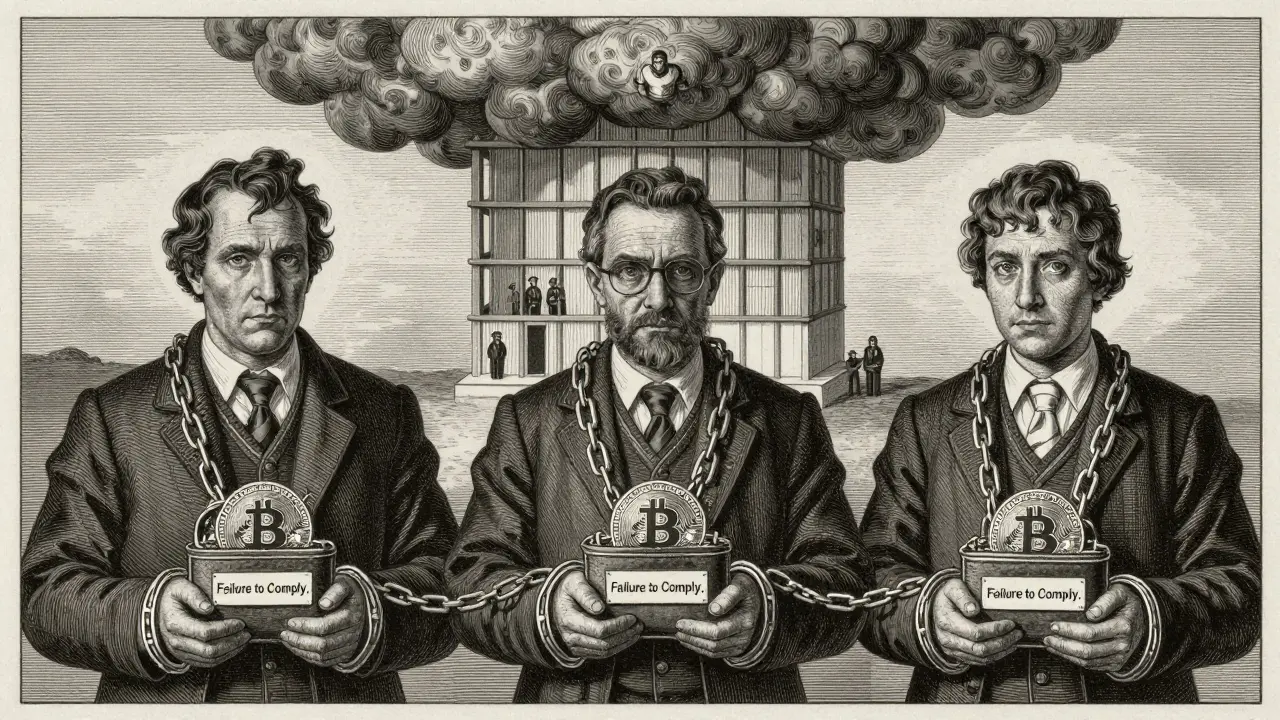

Using cryptocurrency to bypass international sanctions isn't just a regulatory gray area anymore-it's a federal crime that can land you in prison for 30 years. If you thought crypto was anonymous and untraceable, think again. Law enforcement agencies around the world have turned blockchain analytics into a powerful tool, and they're not just fining companies-they're locking up individuals.

Why Crypto Isn't Safe for Sanctions Evasion

Cryptocurrency was once seen as a way to move money without oversight. But that myth shattered fast. Today, every Bitcoin transaction, every Ethereum transfer, and every decentralized finance (DeFi) swap leaves a digital trail. Blockchain explorers like Chainalysis and Elliptic track these movements in real time. When a wallet sends funds to a known sanctioned address-say, one tied to a Russian oligarch or North Korean cyber unit-the system flags it immediately. The U.S. Department of Justice (DOJ) and the UK’s Office for Financial Sanctions Implementation (OFSI) now treat crypto the same as cash or bank accounts. If you move money to or from a sanctioned entity using digital assets, you’re breaking the law. And unlike traditional banking, where institutions can refuse suspicious transactions, many crypto platforms can’t stop incoming transfers. That doesn’t let them off the hook-it makes their responsibility even greater.The $5.1 Billion Crackdown

In 2024 alone, global penalties for crypto-related sanctions and AML violations hit $5.1 billion. The U.S. led the charge, handing out $2.4 billion in fines. That’s nearly half the total. Most of those penalties-83%-came from failures in Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. It wasn’t about complex hacks or advanced tech. It was about basic negligence. Take OKX, one of the world’s largest crypto exchanges. Founded in 2017 and based in Seychelles, OKX claimed to ban U.S. users. But internal messages revealed staff telling American customers how to fake ID documents to access services. The DOJ found over $5 billion in suspicious transactions linked to sanctioned actors. In February 2025, OKX pleaded guilty and agreed to pay $500 million in fines and forfeitures. The company didn’t just lose money-it lost its reputation. And executives? They’re still facing personal liability.The Iurii Gugnin Case: When One Person Pays for a $500 Million Scheme

In June 2025, Iurii Gugnin, founder of the crypto payments firm Evita, was indicted on seven federal charges. He allegedly funneled over $500 million in payments through U.S. banks and crypto exchanges, hiding transactions tied to sanctioned Russian entities. His crimes? Wire fraud, bank fraud, operating an unlicensed money transmitting business, failing to file Suspicious Activity Reports, and money laundering. Each charge carries its own prison time. Wire fraud? Up to 20 years per count. Bank fraud? Up to 30 years. Money laundering? Another 20. Add conspiracy and unlicensed money transmission, and the math adds up fast. Gugnin’s case isn’t an outlier-it’s a template. Prosecutors now stack charges like building blocks. One person, dozens of counts, decades behind bars.

North Korea, Ransomware, and the .74 Million Crypto Trail

North Korea has become one of the most active state actors in crypto sanctions evasion. In June 2025, the DOJ filed a civil forfeiture complaint seeking to seize $7.74 million in cryptocurrency linked to North Korean hackers. The method? IT workers based abroad used fake identities to get paid in crypto for remote jobs. Then, they used mixing services and peer-to-peer trades to launder the funds back to Pyongyang. The same tactics are used by ransomware groups like Trickbot. In 2024, OFAC sanctioned 86 crypto addresses tied to these groups. Exchanges like NetEx24, Bitpapa, and Cryptex were hit hard. Within three months of being sanctioned, inflows to those platforms dropped by an average of 82%. The message was clear: if you help criminals, you’re next.Who’s Really at Risk?

It’s not just the big exchanges. The targets are broad:- Exchange operators who ignore KYC checks

- Payment processors that route funds for sanctioned entities

- Individuals who help friends or family move crypto to avoid sanctions

- Executives who don’t invest in compliance tools

The 30-Year Sentence: How It Adds Up

No single law says, "Evasion with crypto = 30 years." But when prosecutors combine charges, the numbers pile up:- Conspiracy: 5-20 years

- Money laundering: Up to 20 years

- Bank fraud: Up to 30 years per count

- Wire fraud: Up to 20 years per count

- Operating an unlicensed money transmitter: Up to 5 years

- Specific sanctions violations: Up to 30 years

What Compliance Looks Like Today

Passive compliance is dead. You can’t just read the OFAC list once a month and call it done. Regulators now demand:- Real-time blockchain monitoring-tools that flag transactions as they happen

- Automated screening of wallets against sanctioned addresses

- Employee training on red flags and reporting obligations

- Independent audits of AML systems

- Clear reporting lines to compliance officers and legal teams

The Bottom Line

Crypto didn’t make sanctions evasion easier-it made it more dangerous. Law enforcement doesn’t need to catch you in the act. They just need to trace the chain. And with blockchain data, they can go back years. The people getting prison time aren’t hackers in basements. They’re business owners, compliance officers, and executives who thought they could cut corners. If you’re using crypto to move money for someone on a sanctions list-even if you didn’t know they were sanctioned-you’re at risk. Ignorance isn’t a defense. Neither is "everyone else is doing it." The message from regulators is clear: build real compliance, or face real consequences.Can I get in trouble for sending crypto to a friend who later turns out to be sanctioned?

Yes. If you knowingly or negligently sent funds to a wallet linked to a sanctioned person-even through a third party-you can be charged with sanctions evasion. Prosecutors don’t need proof you knew the exact identity, just that you ignored obvious red flags. Always screen wallets before sending crypto.

Are decentralized exchanges (DEXs) safe from sanctions enforcement?

No. While DEXs don’t hold user funds, regulators now target the developers, operators, and liquidity providers who enable large-scale evasion. The DOJ has already frozen assets tied to DEX protocols used by North Korean hackers. If your platform facilitates transactions for sanctioned actors, you’re a target.

How do regulators trace crypto transactions if they’re pseudonymous?

Most crypto isn’t truly anonymous. Wallets often connect to centralized exchanges that require KYC. Chain analysis firms map transaction flows across blockchains and identify clusters of addresses linked to known entities. If a wallet receives funds from a sanctioned address, it gets flagged-even if it’s 10 hops away.

Can a crypto company avoid penalties by claiming they didn’t know about the sanctions?

No. Regulators expect companies to actively monitor sanctions lists and update their screening systems. "Didn’t know" is not a defense. In 2024, 83% of penalties were for AML/KYC failures-not technical ignorance. If you’re not using blockchain analytics tools, you’re already non-compliant.

What happens to executives if their company gets sanctioned?

Executives can be personally fined, banned from the industry, or criminally charged. The DOJ and OFSI increasingly target individuals for "failure of oversight." If you’re in charge of compliance and ignored warning signs, you’re not just risking your job-you’re risking your freedom.