Daisy Chain Crypto: Real Airdrops, Exchange Risks, and Crypto Truths

When you're looking for Daisy Chain Crypto, a no-fluff resource that cuts through crypto hype with real analysis of airdrops, exchanges, and blockchain projects. It's not another newsletter pushing the next moonshot—it's a place where you learn what’s real, what’s fake, and what you should avoid. You’ll find deep dives into crypto airdrop, legit token distributions like FLY and FORWARD, and the scams pretending to be them, plus hard truths about crypto exchange, platforms like BitForex, Sparrow, and Amaterasu that vanished or never existed. These aren’t hypotheticals—they’re real cases where people lost money because they trusted something that had no foundation.

Behind every fake airdrop and dead exchange is a deeper issue: blockchain, the tech that powers crypto, but is often misunderstood or misused. Whether it’s ZK-rollups with different finality times or stablecoins that stop being $1, the details matter. You don’t need to be a developer to get it—you just need to know what to look for. That’s what Daisy Chain Crypto gives you: clear, practical breakdowns that help you spot red flags before you click "claim" or deposit funds.

Below, you’ll find the real stories behind the tokens, exchanges, and trends that actually affect your wallet—not the ones that trend on Twitter. No sugarcoating. Just what you need to know to stay safe and make smarter moves.

What is Lava Network (LAVA) Crypto Coin? A Simple Breakdown of the RPC Infrastructure Project

Lava Network (LAVA) is a decentralized RPC infrastructure that powers blockchain apps with 99.999% uptime. It connects AI agents and wallets to 50+ blockchains through a permissionless network of node providers. LAVA token rewards operators and burns supply to increase scarcity.

What is Peplo Escobar (PEPLO) crypto coin? The meme coin with no trading volume and zero real utility

Peplo Escobar (PEPLO) is a meme crypto with zero trading volume, no exchange listings, and no real utility. Learn why it's not worth investing in and how it compares to other meme coins.

KOM Airdrop by Kommunitas: How to Get Free KOM Tokens and What You Need to Know in 2026

Learn how the Kommunitas KOM airdrop works in 2026, what benefits KOM token holders get, and how to qualify for future free token drops without needing large investments.

WNT (Wicrypt Network Token) Airdrop: What Actually Happened and What You Can Expect in 2026

WNT (Wicrypt Network Token) had no traditional airdrop. Learn how tokens were distributed, current price trends, where to buy, and how to earn WNT by sharing your Wi-Fi - not by signing up for free tokens.

Aerodrome Finance Crypto Exchange Review: Is It the Best DEX on Base?

Aerodrome Finance is the leading decentralized exchange on the Base blockchain, offering low fees, high yields, and a unique veToken system that rewards long-term participation. Learn how it works, how it compares to Uniswap, and whether it's right for you.

Chart Patterns for Cryptocurrency Trading: Recognize Reversals and Continuations

Learn how to identify and trade crypto chart patterns like triangles, flags, and pennants to spot reversals and continuations. Use volume, context, and discipline to turn price action into profitable trades.

FCA Crypto Authorization Requirements for Exchanges in 2026

As of 2026, UK crypto exchanges must obtain full FCA authorization under FSMA, not just register. Learn the five core regulated activities, territorial rules, retail access changes, and how to prepare for compliance.

Hash Collision: What It Means for Blockchain Security

A hash collision can break blockchain security by allowing fake transactions to appear legitimate. Bitcoin uses SHA-256, which is currently secure, but smart contracts and future quantum computers pose real risks.

Nash Crypto Exchange Review: Safe, Regulated, but Lacks Liquidity

Nash crypto exchange offers a regulated, non-custodial way to trade and spend crypto in Europe. Safe and compliant, but low liquidity makes it unsuitable for active traders.

Sphynx Labs Crypto Exchange Review: DeFi App, SPHYNX Token, and Real User Risks

Sphynx Labs isn't a crypto exchange - it's a risky DeFi app with its own token, SPHYNX. Learn about its features, price volatility, user complaints, and whether it's worth using in 2026.

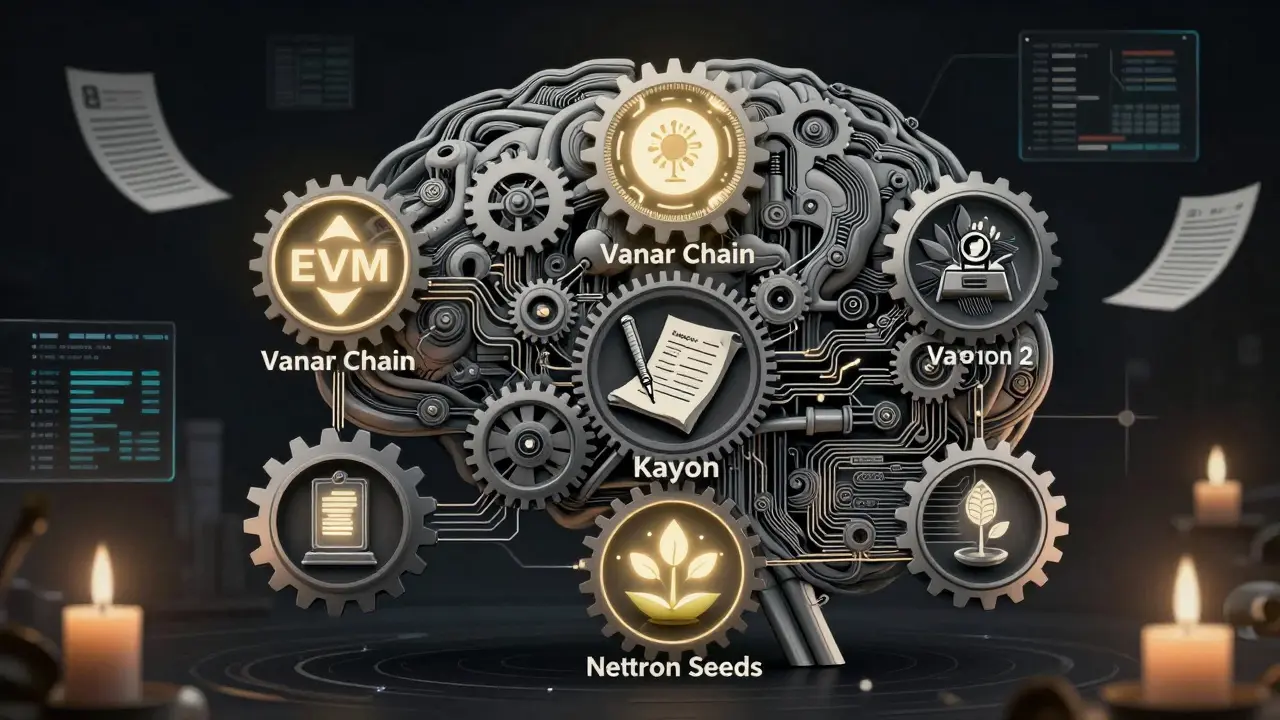

What is Vanar Chain (VANRY) Crypto Coin? AI-Powered Blockchain Explained

Vanar Chain (VANRY) is an AI-native blockchain that integrates artificial intelligence directly into its protocol to enable on-chain reasoning, compliance, and smart financial applications. Unlike traditional blockchains, it doesn't rely on external APIs-it understands data and makes decisions on its own.

How Cryptocurrency and Stablecoins Are Changing Cross-Border Remittances

Cryptocurrency and stablecoins are slashing remittance fees from over 6% to under $0.01 per transaction, offering faster, cheaper cross-border payments-but regulatory hurdles and cash-out access still limit widespread use.