Blockchain & Crypto: Understand Rollups, Stablecoins, and Market Trends

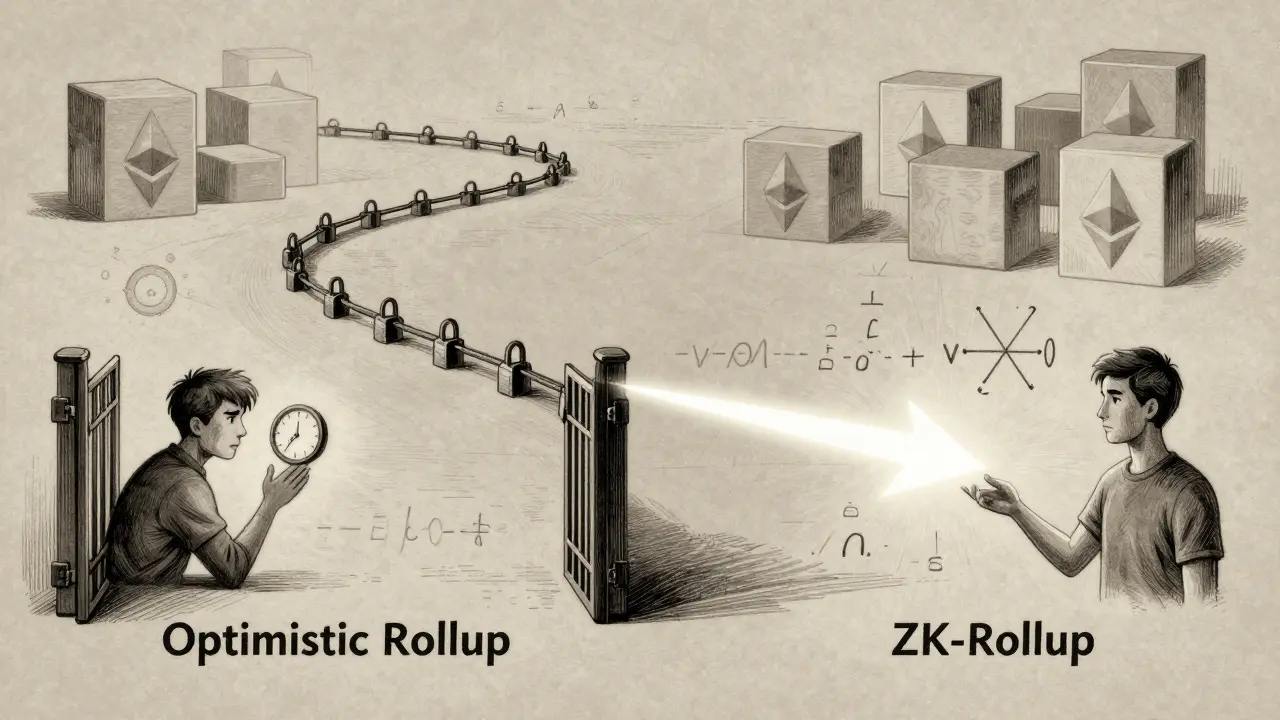

When you hear Blockchain, a decentralized digital ledger that records transactions across many computers so that any involved record cannot be altered retroactively. Also known as distributed ledger technology, it’s the backbone of everything from Bitcoin to AI-powered tokens like TAOBOT. It’s not magic—it’s code, incentives, and rules that keep things working without banks or middlemen. But not all blockchains are built the same. Some, like Ethereum, use rollups, Layer 2 solutions that bundle many transactions off-chain to reduce costs and increase speed on the main blockchain to handle more users. And here’s the catch: optimistic rollups take up to a week to finalize transactions because they trust that no one will cheat, while ZK-rollups, a type of Layer 2 that uses cryptographic proofs to verify transactions instantly do it in minutes. If you’re trading or building on Ethereum, this difference isn’t just technical—it’s money.

Then there’s the quiet danger most people ignore: stablecoin depegging, when a token meant to stay worth $1 suddenly drops in value, causing panic and losses. We saw it with TerraUSD, where billions vanished overnight. Even USDT, the biggest stablecoin, isn’t risk-free—it’s backed by assets that aren’t always transparent. If you’re holding stablecoins as a safe harbor, you need to know what’s really backing them. And if you’re trading in places like India, you’re not breaking any laws—you’re just paying taxes. The crypto regulations India, a framework that taxes crypto gains and requires reporting to financial authorities are clear: track your trades, use registered exchanges, and keep receipts. Skip that, and you’re asking for trouble.

Meanwhile, Bitcoin’s grip on the market is stronger than it’s been in years. At over 60% Bitcoin dominance, the percentage of the total crypto market value controlled by Bitcoin, it’s telling you something: investors are playing it safe. When Bitcoin’s share climbs, altcoins often get left behind. That doesn’t mean they’ll die—it means you need to read the room before jumping in. And not every exchange is worth your time. Amaterasu Finance? Zero activity, zero trust. OKX blocks users in 45+ countries. You don’t need a fancy platform—you need a reliable one.

What you’ll find below isn’t theory. It’s what’s actually happening: how TAOBOT works on Telegram, why some crypto apps vanish overnight, how to trade legally in India, and why Bitcoin’s market share is the quiet signal you should be watching. No fluff. No hype. Just what you need to know before you click buy or sell.

DAO Voting Mechanisms Explained: How Decentralized Governance Works

DAO voting mechanisms ensure fair decisions in decentralized organizations. Learn how Quadratic Voting, Conviction Voting, and Liquid Democracy prevent whale dominance and enhance community participation in blockchain governance.

Future of NFTs in Music Industry: How Blockchain Is Rewriting Artist Revenue and Fan Engagement

NFTs in the music industry are no longer hype-they're reshaping how artists earn and fans connect. With royalty shares, exclusive access, and direct payments, blockchain is fixing music's broken system.

Future of Security Token Markets: How Blockchain Is Rewriting Finance

Security token markets are transforming how assets like real estate, bonds, and commodities are owned and traded using blockchain. With institutional adoption rising and regulatory clarity improving, this $30 trillion industry could redefine finance by 2030.

Understanding ERC-721 NFT Standard: How Unique Digital Assets Work on Ethereum

ERC-721 is the Ethereum standard that makes unique digital ownership possible. Learn how it works, why it dominates NFTs, and how extensions like ERC-721A and ERC-6551 are shaping its future.

Hash Collision: What It Means for Blockchain Security

A hash collision can break blockchain security by allowing fake transactions to appear legitimate. Bitcoin uses SHA-256, which is currently secure, but smart contracts and future quantum computers pose real risks.

Stablecoin Depegging Risks and History: What Happens When $1 Stops Being $1

Stablecoin depegging has cost billions and shattered trust in crypto. Learn how UST collapsed, why USDT remains risky, and what makes a stablecoin truly safe in 2025.

How to Legally Navigate Crypto Regulations in India Without Breaking the Law

India doesn't ban crypto - it taxes it. Learn how to trade Bitcoin and Ethereum legally in India by following tax rules, using registered exchanges, and keeping proper records to avoid penalties and audits.

Amaterasu Finance Crypto Exchange Review: Is It Still Operational?

Amaterasu Finance crypto exchange has zero trading activity, a trust score of 2, and no user base. It's not operational. Avoid it and use proven DEXs like Uniswap or PancakeSwap instead.

OKX Crypto Access Limitations by Country: What’s Blocked and Why

OKX restricts crypto access in over 45 countries due to regulatory laws. Learn which countries are banned, why derivatives are blocked in some places, and how to avoid account termination. Updated for 2025.

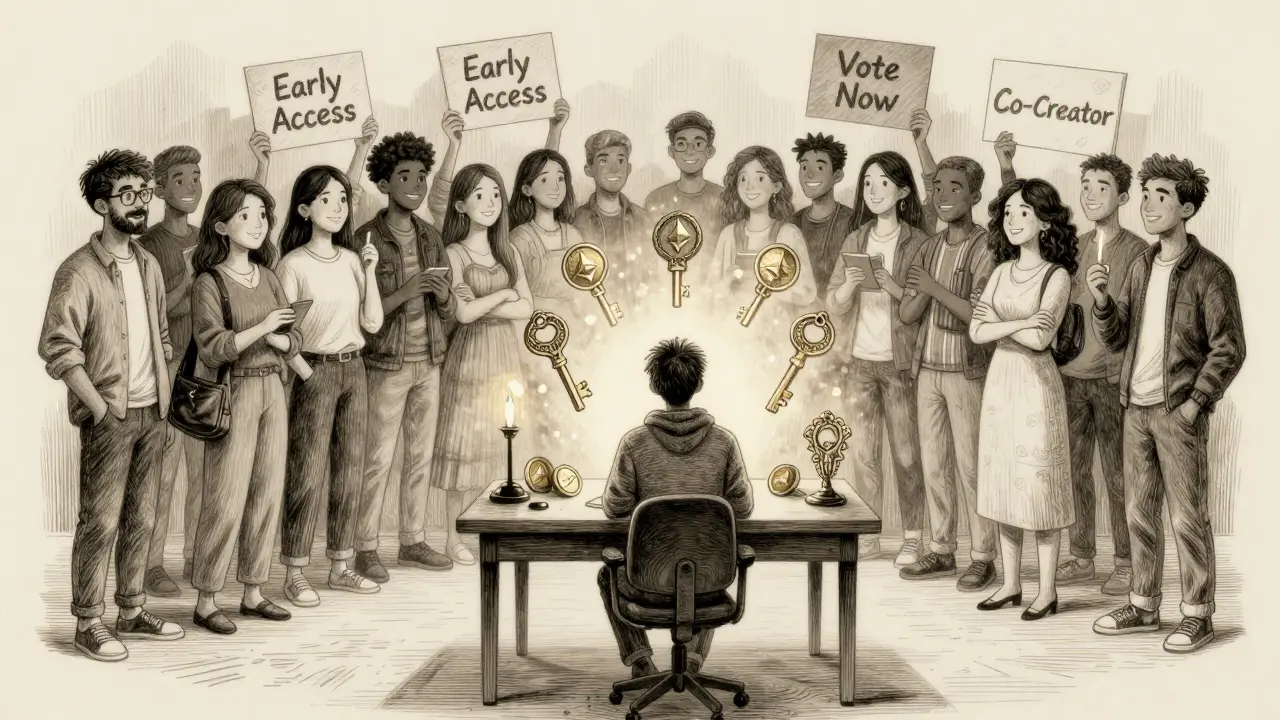

How to Launch a Social Token: A Practical Guide for Creators in 2025

Learn how to launch a social token in 2025 to monetize your community with real utility, not just hype. Step-by-step guide for creators with 5,000+ engaged followers.

Bitcoin Dominance and Total Crypto Market Cap: What It Really Means for Your Investments

Bitcoin dominance shows how much of the crypto market is controlled by Bitcoin. At over 60%, it's at a 4-year high, signaling investor caution. Learn what this means for your portfolio and how to use it to time the market.

Transaction Finality in Rollups: How Optimistic and ZK-Rollups Differ in Speed and Security

Transaction finality in rollups varies drastically between optimistic and ZK-rollups. Optimistic rollups require up to 7 days for full security, while ZK-rollups achieve finality in minutes through cryptographic proofs. Understanding these differences is critical for developers and users alike.